As a quantitative trading researcher proficient in the Wyckoff Method, I will compose a comprehensive and in-depth quantitative analysis report based on the XRPUSDT data and historical ranking data you provided.

XRPUSDT Quantitative Analysis Report (Based on Wyckoff Principles)

Product Code: XRPUSDT

Analysis Date Range: 2025-12-17 to 2026-02-15

Report Generation Date: 2026-02-16

1. Trend Analysis & Market Phase Identification

As of February 15, 2026, the underlying asset XRPUSDT had an opening price of 1.51, a closing price of 1.46, a 5-day moving average (MA_5D) of 1.41, a 10-day moving average (MA_10D) of 1.40, a 20-day moving average (MA_20D) of 1.56. The daily price change was -3.13%, the weekly change was +2.19%, the monthly change was -11.24%, the quarterly change was -20.64%, and the yearly change was -20.64%.

- • Moving Average Alignment and Trend Evolution:

- • Initial State (2025-12-17 ~ 2026-01-01): The price consistently traded below all moving averages, from

MA_5D(1.9-1.96) toMA_60D(2.25-2.09), forming a clear medium-to-long-term bearish alignment (CLOSE < MA_5 < MA_10 < ... < MA_60). The market was in a definitive downtrend. - • Trend Reversal Attempt (2026-01-02 ~ 2026-01-05): Driven by extremely high volume (

VOLUME_AVG_60D_RATIO> 1.8), the price surged with consecutive large bullish candles, rapidly breaking through all intermediate-term moving averages (MA_20D,MA_30D). TheMA_5Dcrossed above theMA_20D, forming a short-term bullish alignment. This was a strong attempt at a "Markup" phase. - • Failed Rally and Trend Reversal (2026-01-06 ~ 2026-02-15): After reaching a high of 2.417, the price quickly retreated, failing to consolidate above

MA_30D. Subsequently, the price fell below all short- and medium-term moving averages and plummeted to 1.137 on February 5. By the end of the analysis period (February 15), the price (1.462) had returned below all moving averages (MA_5D=1.41,MA_60D=1.84), and the bearish alignment was restored.

- • Initial State (2025-12-17 ~ 2026-01-01): The price consistently traded below all moving averages, from

- • Wyckoff Market Phase Assessment:

- • December 2025 to early January 2026: This was the terminal phase of the "Markdown" (downtrend). The price repeatedly tested the 1.80-1.95 range with diminished volume (

VOLUME_AVG_60D_RATIO< 1), indicating exhaustion of selling pressure. - • January 2-5, 2026: The market experienced a brief, high-volume-driven "Markup". However, its duration was short, and subsequent supply was strong.

- • January 6 to February 15, 2026: The market entered a phase of "Distribution" and "Panic Selling". After a high-volume consolidation between 2.0-2.4, the price failed to advance further, a sign of distribution. The vertical crash in early February, accompanied by extreme volume, is a classic case of panic selling. The recent (February 15) high-volume rejection after an initial rally represents an "Upthrust After Distribution (UTAD)", testing the rally following panic selling, indicating the downtrend is not yet complete.

- • December 2025 to early January 2026: This was the terminal phase of the "Markdown" (downtrend). The price repeatedly tested the 1.80-1.95 range with diminished volume (

2. Volume-Price Relationship & Supply-Demand Dynamics

As of February 15, 2026, the underlying asset XRPUSDT had an opening price of 1.51, a closing price of 1.46, a volume of 274,575,547.00, a daily price change of -3.13%, and a 7-day average volume of 133,668,439.93, resulting in a 7-day volume ratio of 2.05.

- • Key Day Analysis:

- • Supply Dominance (Sign of Weakness / Supply Coming In):

- • 2026-01-06: Price declined (-1.86%) on enormous volume (

VOLUME_AVG_60D_RATIO=2.3). This was the "first appearance of significant supply" following the rally, warning of a potential end to the uptrend. - • 2026-01-07 & 08: Consecutive declines with volume remaining high (

VOLUME_AVG_30D_RATIO>1.6) confirmed sustained supply. - • 2026-02-05: A classic case of "Panic Selling". Price crashed -19.67% on record recent volume (

VOLUME_GROWTH=282.8%), withVOLUME_AVG_60D_RATIOreaching 7.07, indicating indiscriminate selling. - • 2026-02-15: Price rallied initially but closed near the low (-3.13%) on renewed high volume (

VOLUME_AVG_60D_RATIO=2.04). This is re-confirmed supply encountered after the bounce.

- • 2026-01-06: Price declined (-1.86%) on enormous volume (

- • Demand Dominance (Sign of Strength / Demand Coming In):

- • 2026-01-02 & 05: Strong rallies (+6.76%, +12.29%) on massive volume, with

VOLUME_AVG_60D_RATIOat 1.03 and 1.80 respectively, indicating aggressive demand entering the market. - • 2026-02-06: On the day following the panic crash, price rebounded +21.01% on still-enormous volume (

VOLUME_AVG_60D_RATIO=6.09). This represents "Stopping Action" (accumulation by large operators after panic), showing smart money absorbing supply at extreme price levels.

- • 2026-01-02 & 05: Strong rallies (+6.76%, +12.29%) on massive volume, with

- • Supply Dominance (Sign of Weakness / Supply Coming In):

- • Quantitative Signals of Supply-Demand Shift:

- • During the January rally, the

VOLUME_AVG_7D_RATIOshowed a positive correlation with price, indicative of healthy demand. However, starting January 7th, price declines were accompanied by elevated volume ratios, confirming the reversal of the supply-demand relationship. - • On February 5th, both

VOLUME_AVG_60D_RATIO(7.07) andVOLUME_GROWTH(282.8%) reached absolute extremes within the data period, marking a climax of market sentiment breakdown and supply.

- • During the January rally, the

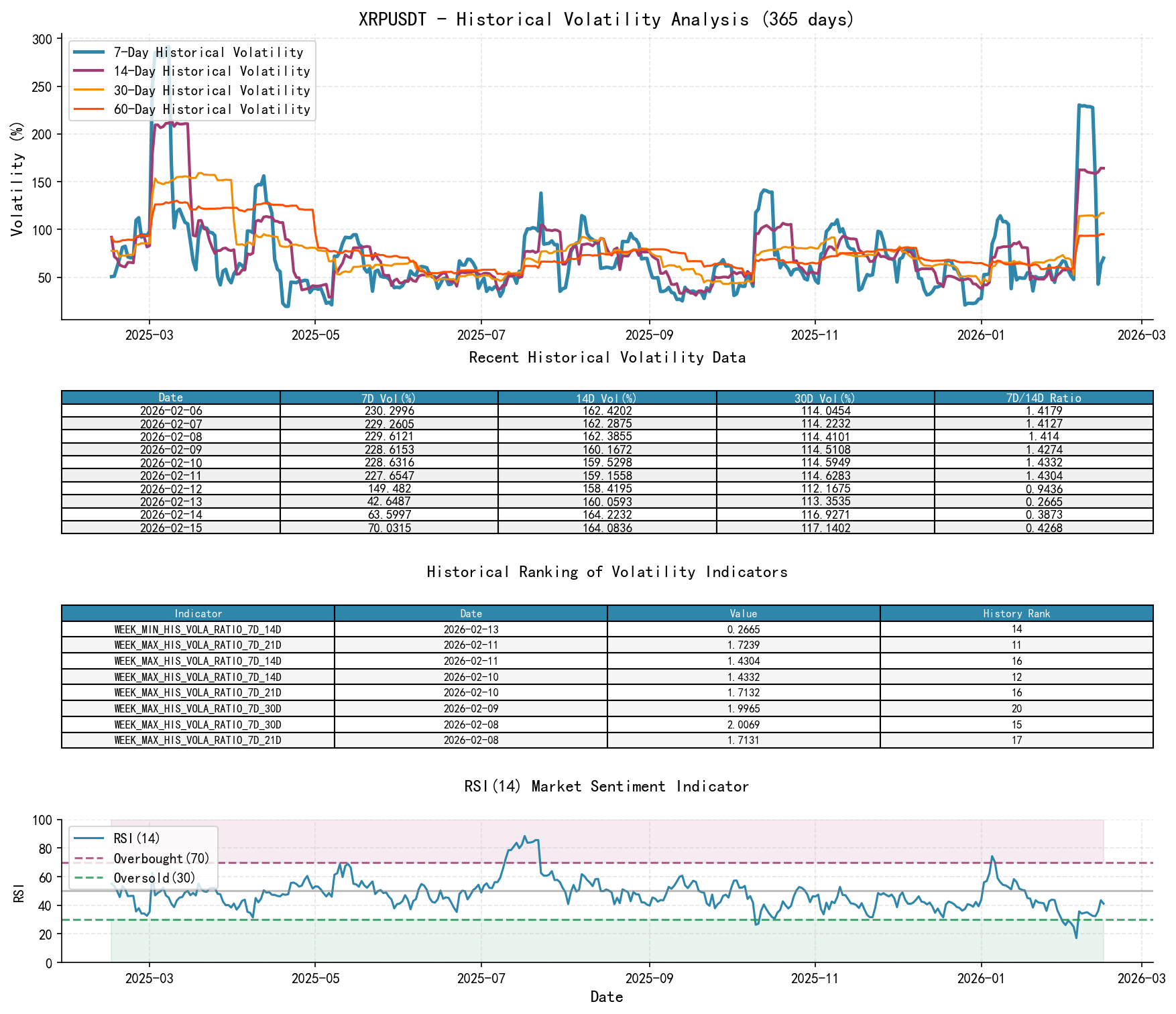

3. Volatility & Market Sentiment

As of February 15, 2026, the underlying asset XRPUSDT had an opening price of 1.51, a 7-day intraday volatility (PARKINSON_VOL_7D) of 0.80, a 7-day intraday volatility ratio (PARKINSON_RATIO_7D_60D) of 0.68, a 7-day historical volatility (HIS_VOLA_7D) of 0.70, a 7-day historical volatility ratio (HIS_VOLA_RATIO_7D_60D) of 0.43, and an RSI of 41.12.

- • Volatility Extremes:

- • Historical Volatility (HIS_VOLA): Between February 5-8, 2026, short-term volatility (

HIS_VOLA_7D) spiked sharply (>1.0), far exceeding medium-to-long-term volatility (HIS_VOLA_RATIO_7D_60D> 1.7). According to historical rankings, theWEEK_MAX_HIS_VOLA_RATIO_7D_30Don February 6th (2.0194) reached the 12th highest level in nearly a decade, indicating abnormal short-term volatility and a market state of panic or trend acceleration. - • Intraday Volatility (PARKINSON_VOL): Exhibited the same pattern, with

PARKINSON_VOL_7Dsurging from 0.96 to 1.75 between February 5-6, andPARKINSON_RATIO_7D_60Dexceeding 2.0, showing an extremely wide intraday price range.

- • Historical Volatility (HIS_VOLA): Between February 5-8, 2026, short-term volatility (

- • Sentiment Indicators:

- • RSI_14: Dropped to 17.05 on February 5th, firmly within the oversold territory. Historical ranking data shows this value is the lowest in nearly a decade (HISTORY_RANK: 1), confirming market sentiment reached an extreme level of pessimism and panic.

- • Volatility Contraction: From February 13-14, short-term volatility metrics (

HIS_VOLA_7D,PARKINSON_VOL_7D) declined rapidly. ThePARKINSON_RATIO_7D_14Dfell to 0.5254 on February 13th (the 12th lowest in nearly a decade), suggesting initial release of panic and a short-term market consolidation.

4. Relative Strength & Momentum Performance

- • Periodic Return Analysis:

- • Short-term (WTD/MTD): As of February 15th,

WTD_RETURNwas +2.19%, whileMTD_RETURNwas -11.24%. Momentum exhibited a highly unstable, choppy characteristic. The sharp decline in early February (-26.26% MTD on 2026-02-05) severely damaged intermediate-term momentum. - • Medium-to-Long term (QTD/YTD/TTM): Both

QTD_RETURNandYTD_RETURNwere around -20%, whileTTM_36remained high at +264.5%. This indicates that although the long-term uptrend structure persists, the market has shifted into a significantly weaker intermediate-term phase, undergoing a deep mid-cycle correction.

- • Short-term (WTD/MTD): As of February 15th,

- • Momentum & Volume-Price Confirmation: The strong positive momentum in early January was validated by high-volume rallies. The sharp negative momentum in February was similarly validated by extreme volume. The rapid shift in momentum direction aligns perfectly with the supply-demand role reversal revealed by volume-price analysis.

5. Large Operator (Smart Money) Behavior Identification

- • Accumulation: Occurred on February 5-6, 2026. Following a panic selling event (-19.67%), a powerful rebound (+21.01%) occurred the very next day. Volume on both days ranked among the highest in the period (

VOLUME_AVG_60D_RATIOof 7.07 and 6.09, historical ranks 10 and 16). This combination of "panic selling + massive absorption" is a classic Wyckoff event representing active accumulation by large operators at emotionally distressed price levels. - • Distribution: Occurred from January 6 to late January 2026. The price consolidated at high levels between 2.0-2.4, with multiple occurrences of high-volume stalling or declines (e.g., Jan 6, 7, 8). This represents large operators distributing shares to the public chasing the rally at elevated prices.

- • Current Behavior (2026-02-15): After rallying to 1.671, the price faced selling pressure and closed near the low at 1.462 on increased volume. This is not accumulation but rather "re-distribution" or a "failed rally test". Smart money either used the bounce to distribute or tested and found that overhead supply remains heavy, showing no intention to push prices higher at this level.

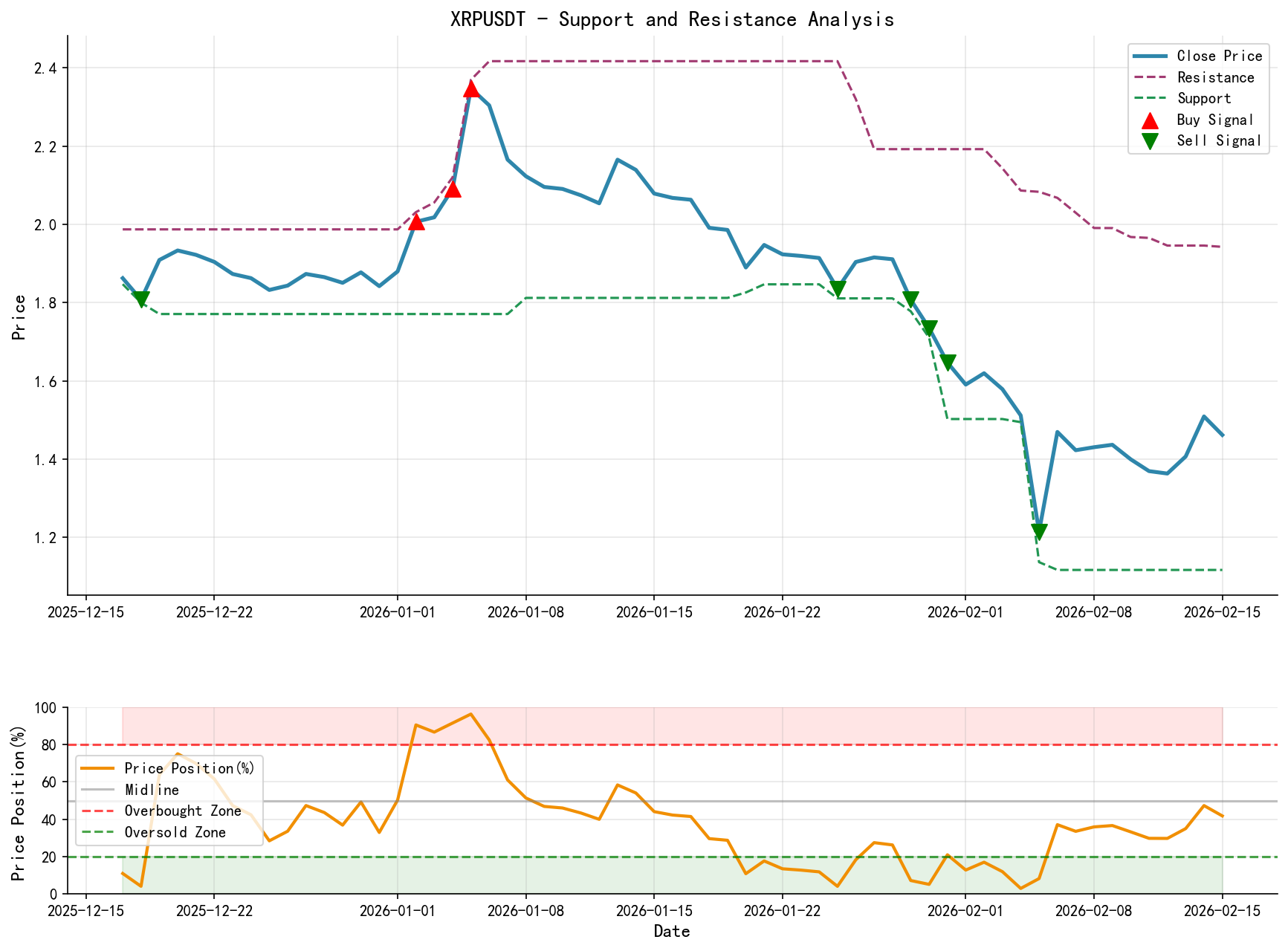

6. Support/Resistance Analysis & Trading Signals

- • Key Price Levels:

- • Strong Resistance: 1.671 (February 15, 2026 high), also the point of recent rally failure. 2.000-2.100, the lower boundary of the January distribution range and a psychological level.

- • Strong Support: 1.137 (February 5, 2026 low), the extreme low formed during panic selling. 1.350-1.400, the preliminary demand area formed between February 10-14.

- • Trend Watershed: 1.500-1.550, the area where the current

MA_5D,MA_10Dand price are converging. Holding above this area is the first step towards stabilization.

- • Wyckoff Composite Trading Signals:

- • Current Phase: The market is in the terminal stage of the "Automatic Rally" following "Panic Selling", having just completed a failed secondary test (February 15). The overall trend remains bearish.

- • Operational Recommendation: Cautiously watch for long opportunities; wait for clearer accumulation structure formation. Chasing the current rally is not advisable.

- 1. Observe/Wait: Price needs to build an "accumulation range" above 1.137 and show signals of low-volume tests of support without making new lows. Monitor price action in the 1.35-1.40 zone.

- 2. Aggressive Strategy (Higher Risk): If price breaks below 1.137 again on high volume, exit and stand aside, as the downtrend would likely continue.

- 3. Robust Entry Signal: Wait for price to break above and hold above 1.671 (February 15 high) on significant volume, with short-term moving averages (

MA_5D,MA_10D) turning up to provide support, which would signal the start of a new uptrend.

- • Future Validation Points:

- 1. Demand Validation: When price retraces to the 1.35-1.40 or 1.14 area, does volume contract significantly (

VOLUME_AVG_60D_RATIO< 0.8)? This is key to testing if supply is exhausted. - 2. Supply Validation: Does any rebound towards the 1.55-1.67 area again encounter high-volume stalling or rejection? If yes, it confirms distribution is ongoing.

- 3. Structure Validation: Can price form a higher low (

Higher Low) above 1.137 and gradually lift its volatility center? This would mark the beginning of bottom formation.

- 1. Demand Validation: When price retraces to the 1.35-1.40 or 1.14 area, does volume contract significantly (

Summary Conclusion: Following a brief but intense rally in January, XRPUSDT has confirmed entry into a mid-term distribution and correction phase. The early February crash represented a climax in market sentiment (historically low RSI and high volume ratios), during which signs of smart money accumulation appeared. However, the failed rebound on February 15 indicates that supply pressure persists, and the market has not yet completed its bottoming process. Traders should patiently await the formation of a more solid accumulation structure and demand-dominant price-volume signals. The current strategy should be defensive and observational, avoiding blind bargain-hunting within a downtrend.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. While the author strives for objectivity and fairness, no guarantees are made regarding its accuracy or completeness. The market carries risks; investment requires caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Wyckoff Volume-Price Market Interpretations are published daily before the 8:00 market open. Your feedback and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: