TRUMPUSDT Quantitative Analysis Report

Analysis Period: 2025-12-17 to 2026-02-15

Generation Date: 2026-02-16

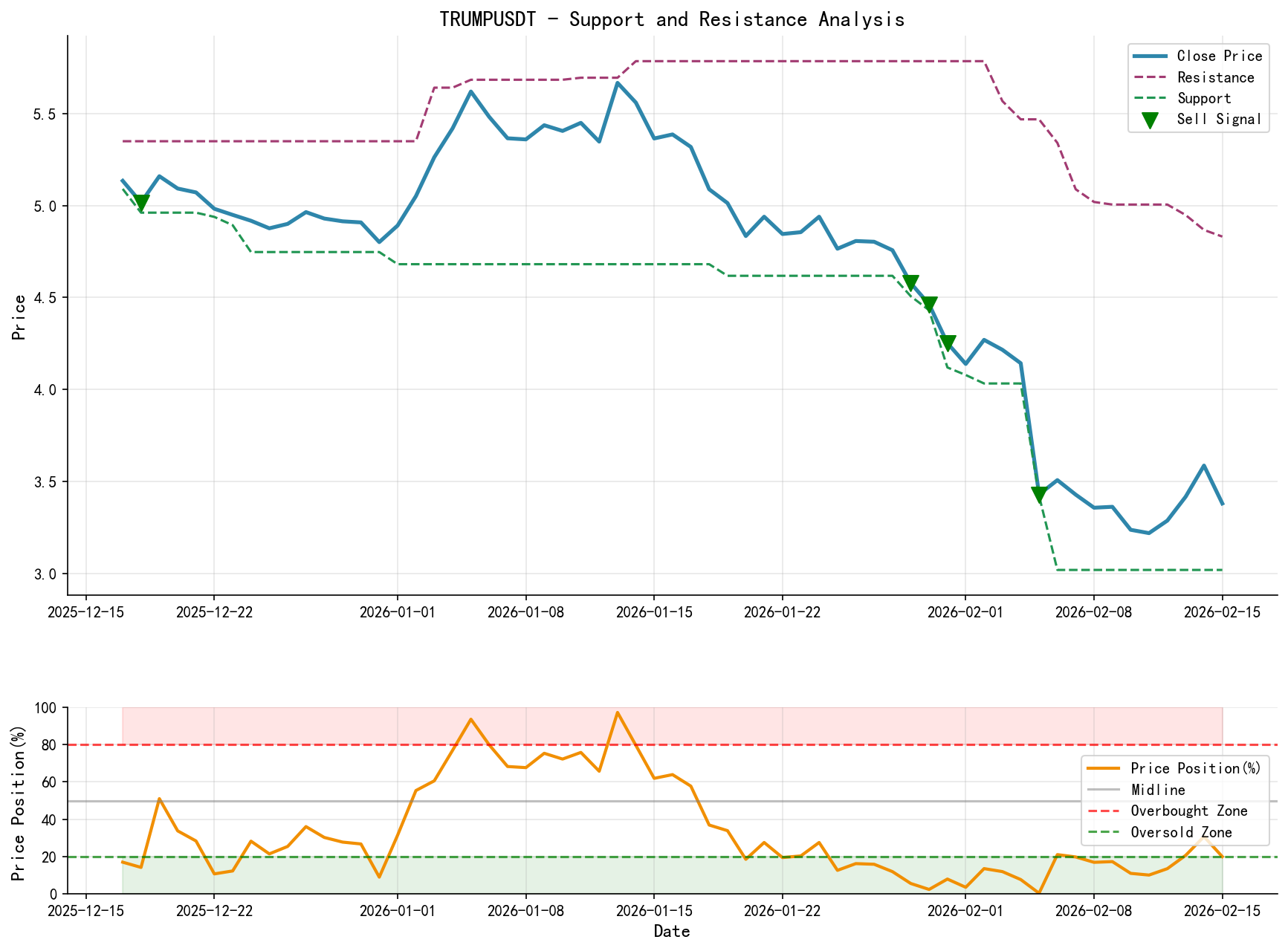

1. Trend Analysis and Market Phase Identification

As of February 15, 2026, the underlying asset TRUMPUSDT had an opening price of 3.59, a closing price of 3.38, a 5-day moving average of 3.35, a 10-day MA of 3.38, a 20-day MA of 3.91, a daily change of -5.74%, a weekly change of 0.68%, a monthly change of -20.48%, a quarterly change of -29.58%, and a yearly change of -29.58%.

- • Moving Average Alignment and Trend Structure:

- • Phase One (2025-12-17 to 2026-01-05): Acceleration and Exhaustion of Downtrend. At the start, the price (~5.1) was strongly suppressed by all moving averages (MA_5D ~5.44 to MA_60D ~6.56), exhibiting a standard bearish alignment. The price continued to decline, testing lows around 4.8 in late December. Subsequently, the market entered phases of Preliminary Support (PS) and Panic Selling (SC) (December 29-31), with the price hitting a new low of 4.801 on significantly increased volume (VOLUME_AVG_7D_RATIO reached 1.43). In early January 2026, the price experienced an Automatic Rally (AR), rapidly rising above all short-term moving averages. The MA_5D crossed above the MA_20D on January 5, forming a "golden cross," marking a temporary interruption of the downtrend.

- • Phase Two (2026-01-06 to 2026-02-15): Failed Rebound and Resumption of the Main Downtrend. After rebounding to a high of 5.666 on January 13, the price failed to challenge the key resistance of the MA_60D and turned downward. The price broke below the MA_20D on January 18 and fell below the MA_5D, MA_10D, and MA_30D on January 29, forming a "death cross" cluster. Since then, all moving averages have resumed a bearish alignment and diverged downward. Currently (February 15), the price at 3.381 is well below all moving averages (MA_5D=3.350, MA_60D=4.726), indicating a clear Major Downtrend.

- • Market Phase Assessment:

- • Late 2025 to Early January 2026: Exhibited a typical Panic Selling (SC) and Automatic Rally (AR) structure, forming an attempt at a temporary bottom within the downtrend.

- • Mid-January 2026 to Present: The Secondary Test (ST) and test for New Low Supply (LPSY) failed, proving the rebound was Distribution or a Bear Market Rally. The market has entered a more intense Markdown phase. The sharp plunge in early February (3.43 to 3.02) accompanied by massive volume (see below) is a sign of a new round of Panic Selling (SC).

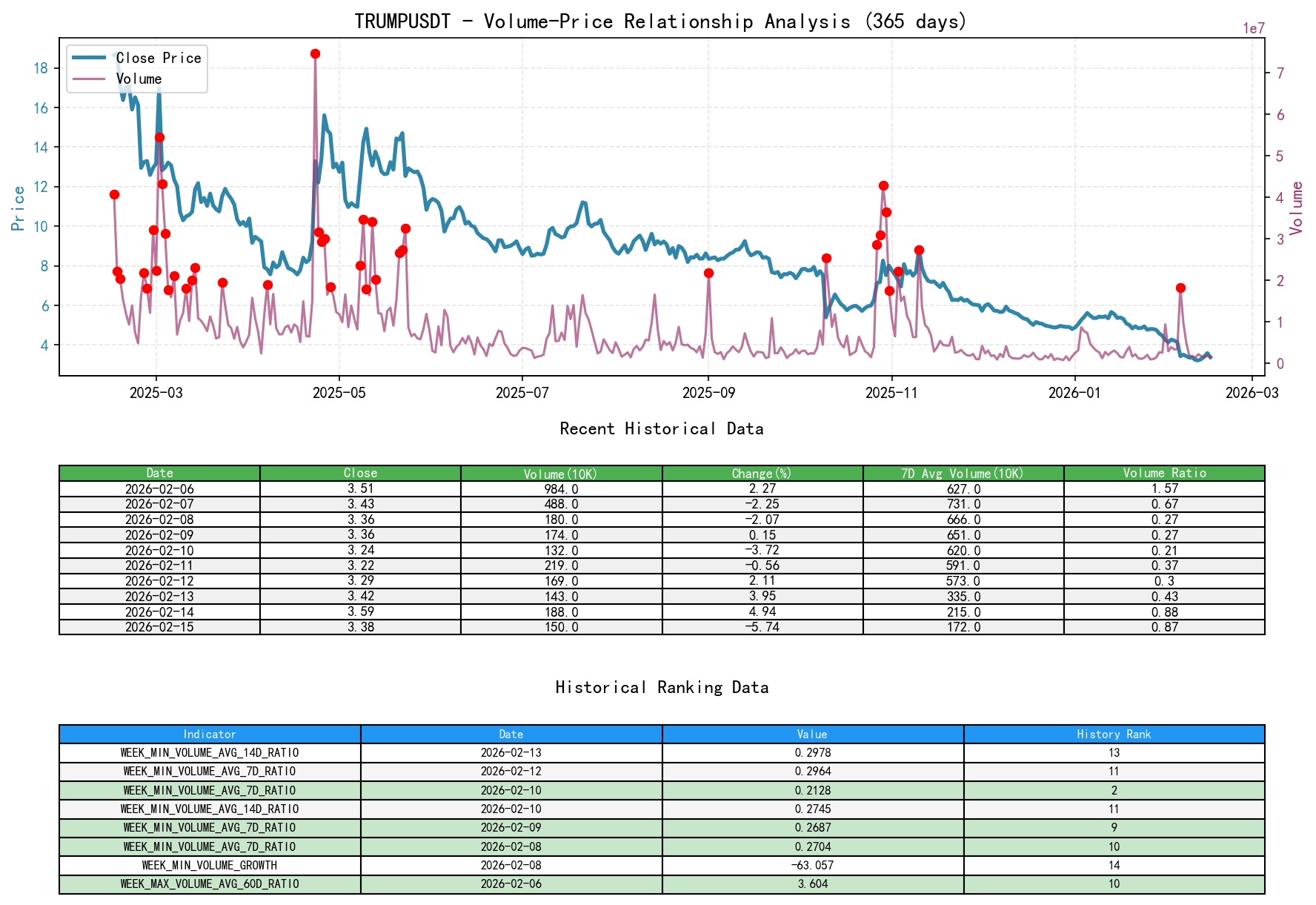

2. Volume-Price Relationship and Supply-Demand Dynamics

As of February 15, 2026, the underlying asset TRUMPUSDT had an opening price of 3.59, a closing price of 3.38, volume of 1501463.93, a daily change of -5.74%, volume of 1501463.93, a 7-day average volume of 1727327.80, and a 7-day volume ratio of 0.87.

- • Identification of Key Volume-Price Signals:

- • Panic Selling (SC):

- 1. 2025-12-31: Price fell -2.18%, volume expanded to 1.43 times the 7-day average (historical ranking 5th highest), closing near lows. Shows a large influx of supply.

- 2. 2026-01-31: Price plummeted -4.73%, volume expanded to 4.98 times the 14-day average (historical ranking 8th highest), setting a new cycle low. This is a stronger SC signal.

- 3. 2026-02-05: Price plummeted -17.21%, volume surged 426.9% (historical ranking 5th highest), reaching 4.54 times the 7-day average (historical ranking 8th highest). This is the most extreme panic day within the cycle.

- • Demand Attempts and Failures:

- 1. 2026-01-02/03: Rising price on high volume (VOLUME_AVG_14D_RATIO reached 2.29 and 5.84 respectively), showing active demand entering the market, driving the Automatic Rally (AR).

- 2. 2026-01-13/14: After rising to 5.666, the following day saw high volume with stalled advance (VOLUME_AVG_7D_RATIO=1.19 while price fell -1.89%). This is a clear signal of supply overpowering demand, marking the formation of the rebound high (UT).

- 3. 2026-02-13/14: Low-volume rebound (VOLUME_AVG_7D_RATIO 0.43 and 0.88) after the plunge. Weak demand was unable to absorb the overhead supply, and the rebound was quickly erased by the high-volume decline on February 15 (VOLUME_AVG_7D_RATIO=0.87).

- • Supply-Driven Decline: Throughout February, most declining days (e.g., 02-01, 02-03, 02-04, 02-07, 02-10, 02-15) were accompanied by volume above the 7-day or 14-day average (RATIO>1), indicating persistent, active supply during the decline.

- • Panic Selling (SC):

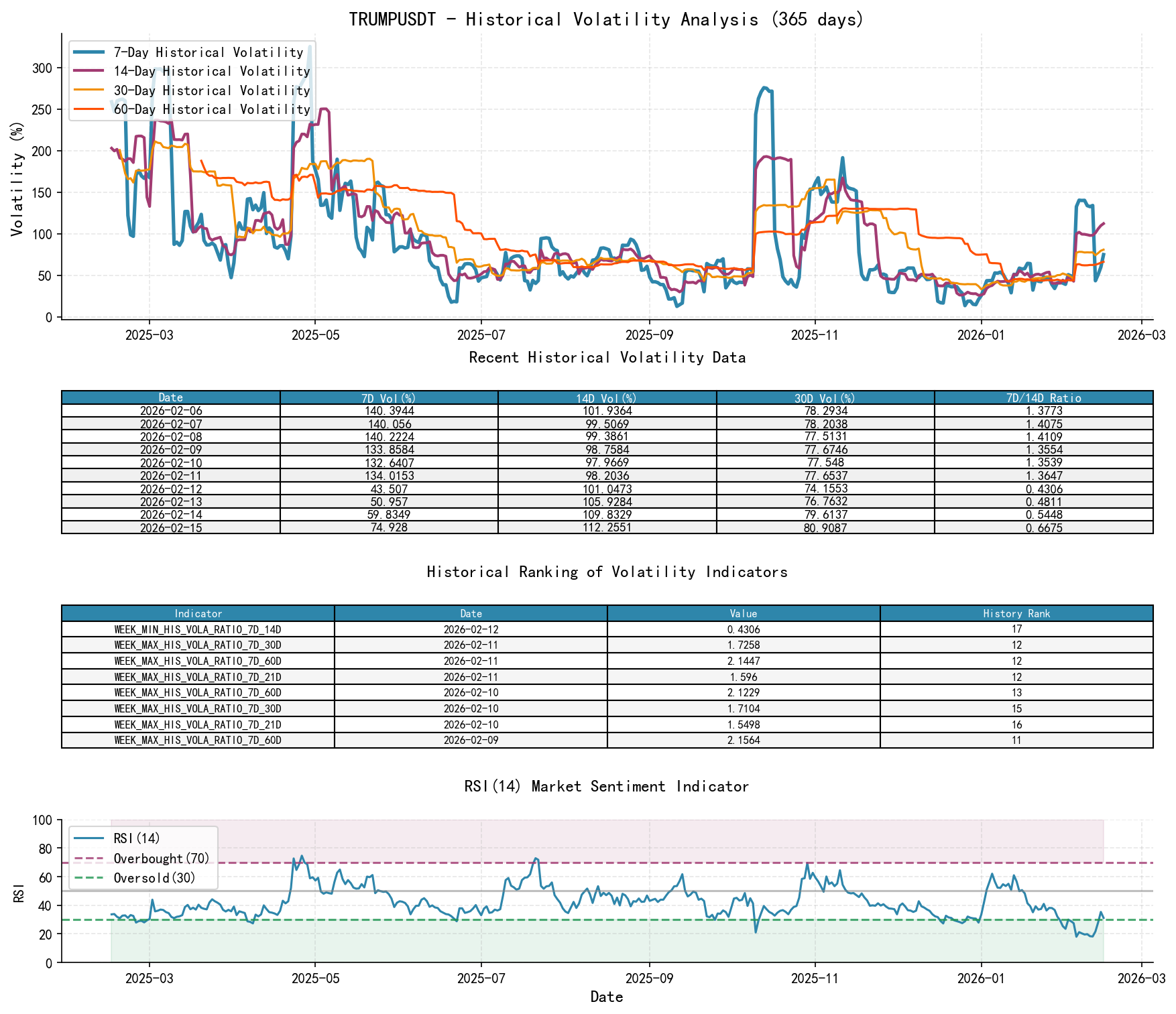

3. Volatility and Market Sentiment

As of February 15, 2026, the underlying asset TRUMPUSDT had an opening price of 3.59, a 7-day Parkinson volatility of 0.68, a 7-day Parkinson volatility volume ratio of 0.79, a 7-day historical volatility of 0.75, a 7-day historical volatility volume ratio of 0.67, and an RSI of 31.19.

- • Extreme Volatility Expansion: Recent market volatility has surged sharply into historical extremes.

- • Historical Volatility (HIS_VOLA): The 7-day historical volatility reached 1.404 on 2026-02-06, and the 14-day volatility reached 0.999 on 02-05 (historical ranking 1st). Short-term volatility far exceeds long-term (~0.63 for 60-day volatility), and volatility ratios across timeframes (HIS_VOLA_RATIO) have all reached historical highs within the top 15 (e.g., the 7D/60D ratio reached 2.26 on 02-08, ranking 8th). This indicates market sentiment is in a state of extreme panic and chaos.

- • Parkinson (Intraday) Volatility (PARKINSON_VOL): Conclusions align with historical volatility. The 7-day Parkinson volatility reached 1.079 on 02-06, and volatility ratios across timeframes also hit historical highs (e.g., the 7D/60D ratio reached 1.985 on 02-06, ranking 8th).

- • RSI Oversold Confirmation: RSI_14 hit its cycle low of 18.01 on 2026-02-05 (historical ranking 1st, extreme oversold) and dipped below 20 multiple times in early February. This confirms that market sentiment has reached a critically pessimistic extreme, typically accompanying the late stages of a Panic Selling (SC) phase.

4. Relative Strength and Momentum Performance

- • Momentum Universally Negative and Accelerating Downward:

- • Short-term (WTD): Consistently negative, reaching an extreme weekly decline of -25.08% in the week of February 5.

- • Medium-term (MTD/QTD): Briefly turned positive in January 2026 but deteriorated rapidly in February. Current MTD return is -20.48%, and QTD return is -29.58%.

- • Long-term (YTD): The year-to-date return for 2026 is -29.58%, indicating the asset is in a state of strong absolute weakness.

- • Momentum data is highly consistent with the conclusions from price trend and volume-price analysis, confirming the market is currently under strong negative momentum.

5. Large Investor (Smart Money) Behavior Identification

- • Early January Rebound (2026-01-02 to 01-05): Smart money capitalized on the lows following year-end Panic Selling (SC) to conduct aggressive buying (Accumulation). The massive volume surge (VOLUME_AVG_14D_RATIO reaching 5.84) indicates substantial capital absorbing selling pressure, aiming to engineer a rebound.

- • Mid-January Distribution (2026-01-13 to 01-15): When the price rebounded to the 5.6+ zone, it exhibited high-volume stagnation and high-volume decline. This aligns with Distribution characteristics: smart money distributed the shares accumulated in early January at higher prices to retail investors chasing the rally. The RSI reached a phase high of 60.99 (historical ranking 19), providing an overbought context.

- • Early February Panic and Absorption Test (2026-02-05 to Present):

- 1. Triggering Panic (Shakeout): The epic high-volume crash on February 5 (-17.21%) washed out all weak long positions, a classic shakeout maneuver.

- 2. Observing Absorption: After the crash, volume remained relatively high (though lower than February 5), with prices fluctuating violently in the 3.0-3.6 range. Smart money is observing and testing whether sufficient natural demand emerges in this zone and if panic selling has dried up. Current signs show that each minor rally meets selling pressure, indicating supply is not yet exhausted, and smart money has not yet entered on a large scale to accumulate.

6. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Resistance Levels (Supply Zones):

- • R1: 3.60-3.65 (Upper bound of recent consolidation range and the February 15 high).

- • R2: 4.25-4.30 (Low of the January 31 panic selling day, now a strong resistance).

- • R3: 5.00-5.20 (January downtrend consolidation platform, area of multiple moving average convergence).

- • Support Levels (Demand Zones):

- • S1: 3.20-3.25 (Lower bound of recent consolidation range).

- • S2: 3.00-3.05 (Absolute low from February 6, a key psychological and technical support).

- • S3: 2.80 (Theoretically projected level based on volatility expansion, no historical validation yet).

- • Resistance Levels (Supply Zones):

- • Composite Wyckoff Event and Trading Signals:

- • Current Phase: In the Secondary Test (ST) or Low-Level Consolidation phase following Panic Selling (SC). The market is searching for signals of declining downward momentum and emerging demand.

- • **Trading Signal: ** Strongly bearish trend, awaiting signs of stabilization. Blindly buying the dip is inadvisable at present. Any weak bounce towards the R1 resistance zone (3.60-3.65) presents a potential short-selling or reduction opportunity.

- • Operational Recommendations:

- 1. Short Strategy (Aggressive): If the price rebounds to the R1 zone (3.60-3.65) and shows signs of stalling or bearish reversal patterns on 15-minute or 1-hour charts (e.g., long upper wicks, bearish engulfing), consider a light short position with a stop-loss above 3.75, targeting S1.

- 2. Bottom-Fishing Strategy (Conservative, Requires Confirmation): Absolutely avoid buying at current prices. Potential long opportunities require waiting for the following signals to appear simultaneously:

- • Price Level: Formation of a clear Spring or Ultimate Shakeout (UTAD) pattern at or above S2 (3.00-3.05) (i.e., price briefly breaks below support then forcefully reclaims it).

- • Volume-Price Level: Appearance of a "high-volume bullish reversal bar halting the decline" or Significant reduction in volume (SOT) during a secondary test following a panic low, indicating supply exhaustion.

- • Momentum Level: RSI_14 forms a clear bullish divergence.

- • If the above signals appear, consider entering after confirmation, with an initial stop-loss below the low of the signal bar/candle, and the first target at R1.

- • Future Validation Points:

- 1. Bearish Validation: Price breaks below S2 (3.00) on high volume, opening new downside space targeting S3.

- 2. Bullish Validation: Price exhibits all or most signals outlined in the bottom-fishing strategy, followed by a high-volume breakout and sustained hold above R1, potentially forming a short-term bottom with a rebound target towards R2.

Executive Summary: TRUMPUSDT is in a clear major downtrend. After smart money successfully engineered a rebound in early January and completed distribution, they triggered market panic through an extreme crash in early February. The price is currently consolidating near absolute lows within a historically extreme volatility environment. Although sentiment indicators show extreme oversold conditions, the volume-price relationship indicates supply remains dominant and demand is weak. Until clear Wyckoff accumulation signals (e.g., Spring, SOT) appear, the strategy should primarily focus on following the bearish trend or remaining on the sidelines, avoiding premature bottom-fishing. Key levels to watch are the 3.00 support and 3.60-3.65 resistance.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality in the content but makes no guarantees regarding its accuracy or completeness. Markets involve risks, and investments require caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff volume-price market interpretations are released daily at 8:00 AM before the market open. Your comments and shares are greatly appreciated and crucial. Let's work together to see the market signals.

Member discussion: