Understood. As a quantitative trading researcher proficient in the Wyckoff Method, I will compose a comprehensive and in-depth quantitative analysis report based on the provided TONUSDT data and historical ranking metrics. All conclusions will be strictly derived from the data and aligned with Wyckoff price-volume principles.

TONUSDT Quantitative Analysis Report

Product Code: TONUSDT

Analysis Date Range: 2025-12-17 to 2026-02-15

Report Generation Date: 2026-02-16

1. Trend Analysis and Market Phase Identification

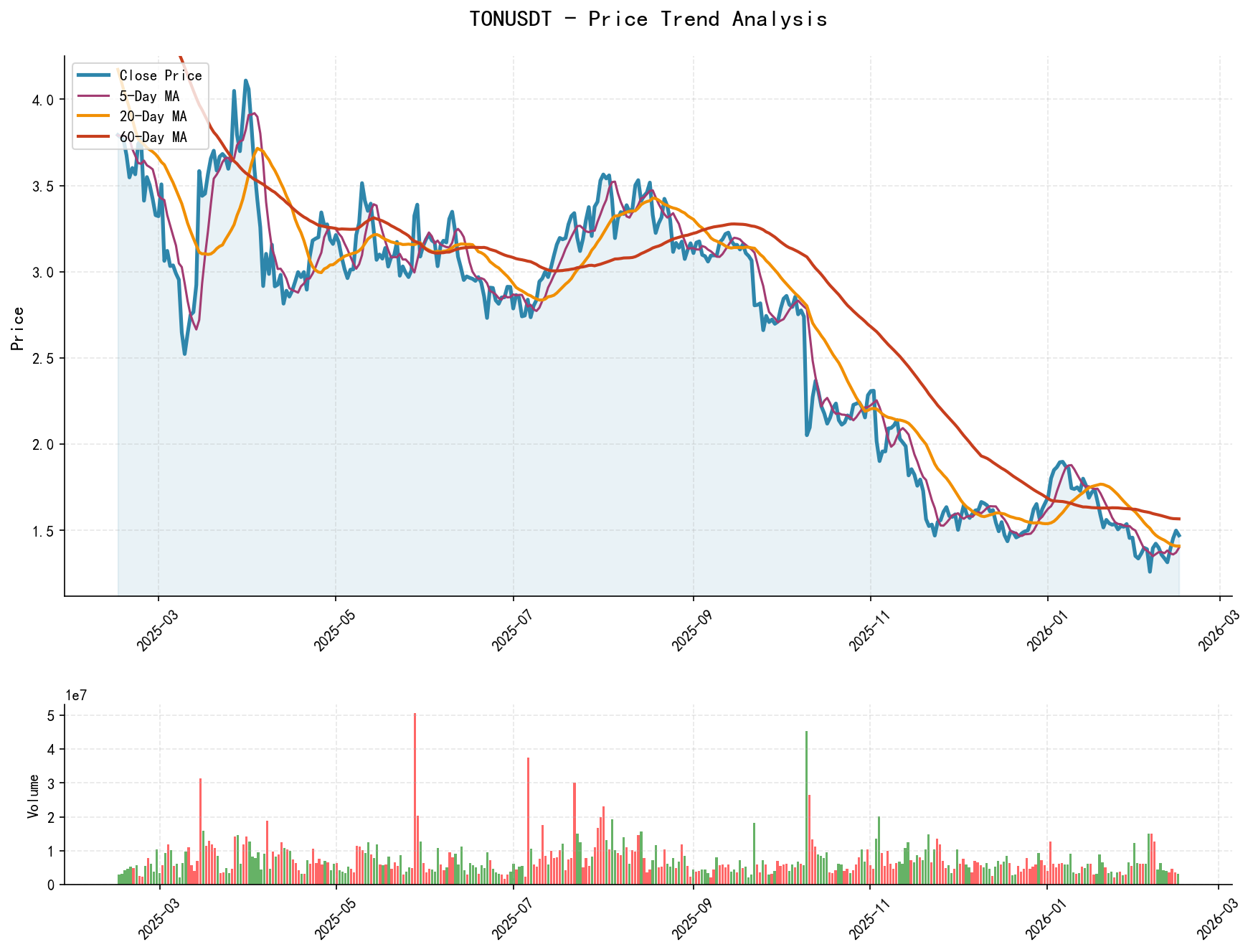

As of 2026-02-15, the subject TONUSDT recorded: Open 1.50, Close 1.47, MA_5D 1.40, MA_10D 1.38, MA_20D 1.41, Daily Change -1.87%, Weekly Change 5.07%, Monthly Change 8.80%, Quarterly Change -11.33%, Yearly Change -11.33%.

Data Derivation:

- • Price vs. Moving Average Relationship: As of 2026-02-15, the closing price (1.471) is significantly below all key moving averages (MA_5D=1.400, MA_10D=1.384, MA_20D=1.409, MA_30D=1.469, MA_60D=1.567). The moving averages across periods are in a bearish alignment (MA_5D < MA_10D < MA_20D < MA_60D), clearly indicating the market is in a medium to long-term downtrend.

- • Price Action and Phase Identification: The price movement within the analysis period exhibits a clear structure of "Distribution - Markdown - Panic - Potential Stabilization":

- 1. Distribution: From 2026-01-02 to 01-06, price rallied rapidly within the 1.80-1.95 range and then consolidated. During this period, the RSI_14 consistently remained in the overbought zone of 69-72 (ranking 4th, 5th, 8th, and 10th highest in the past 10 years), yet upward momentum weakened, failing to sustain new highs.

- 2. Markdown: Starting from 2026-01-07, price broke below the 1.87 support level, initiating the primary decline. The moving average system transitioned from bullish to bearish alignment, confirming the downtrend.

- 3. Selling Climax: On 2026-01-31, price plummeted 7.27% on heavy volume, with trading volume reaching 16.55 million USDT. The Volume/14-day Avg Volume ratio (2.84) reached the 13th highest level in the past 10 years, marking the peak of panic selling. The price touched a low of 1.250.

- 4. Automatic Rally & Secondary Test: A strong rebound (+10.87%) occurred on 2026-02-06 with exceptionally high volume (ratio ranking 3rd), which can be viewed as the natural automatic rally following panic selling. Subsequently, price consolidated in a narrow range of 1.315-1.338 from Feb 10-12 on low volume, testing the previous low support, constituting a potential secondary test.

Wyckoff Principle Interpretation:

The current market is in the late stage of the Markdown phase and may be forming the initial structure of an Accumulation range. The panic selling on Jan 31 can be viewed as the "Selling Climax (SC)", the rebound on Feb 6 as the "Automatic Rally (AR)", and the recent narrow consolidation and the low-volume small bearish candle on Feb 15 may be forming the left side of a "Secondary Test (ST)" or "Spring". The key validation point is whether the price can stabilize in the 1.26-1.34 zone and show signs of demand (rising on high volume).

2. Price-Volume Relationship and Supply-Demand Dynamics

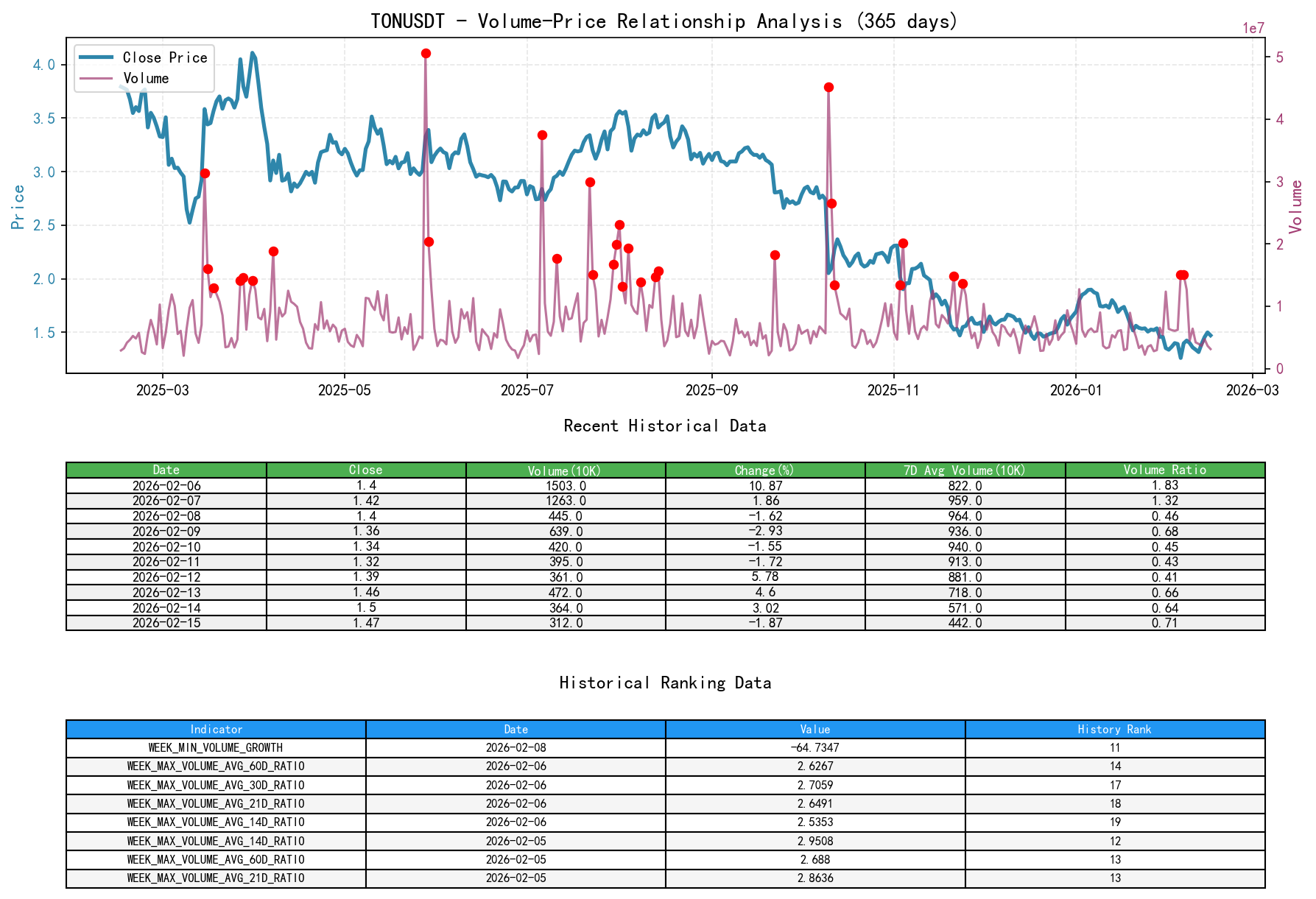

As of 2026-02-15, the subject TONUSDT recorded: Open 1.50, Close 1.47, Volume 3123471.32, Daily Change -1.87%, Volume 3123471.32, 7-day Avg Volume 4429175.70, 7-day Volume Ratio 0.71.

Data Derivation:

- • Key Day Analysis:

- • Demand-dominated day: On 2026-01-02, price surged 6.38% with a Volume/14-day Avg Volume ratio as high as 2.34 (ranking 19th), indicating clear breakout demand.

- • Supply-dominated day: On 2026-01-09, price fell 6.23% with a Volume/14-day Avg Volume ratio of 1.39; falling on high volume indicates strong supply. 2026-01-31 was an even more extreme supply day, with a large price drop and extreme volume, typical of panic selling.

- • Lack of Demand day: From 2026-02-10 to 02-12, price experienced consecutive small declines after rebounding from lows, with volume shrinking to 45%-62% of the 14-day average, showing a lack of follow-up demand support for the rebound.

- • Supply exhaustion day: On 2026-02-15, price fell slightly by 1.87%, but volume was only 44% of the 14-day average (VOLUME_AVG_14D_RATIO=0.444), and this occurred near the previous lows, indicating some weakening of selling pressure.

- • Volume Anomaly Indicator (VOLUME_AVG_RATIO): Recent volume activity has significantly decreased from extreme highs. The volume ratios on Feb 5 and 6 both ranked within the top 20 historically, showing intense market sentiment fluctuations. Current volume (Feb 15) has fallen below the average, indicating the market has entered a low-activity observation period.

Wyckoff Principle Interpretation:

Supply experienced a concentrated, extreme release on the panic day (Jan 31) (long bearish candle on huge volume). The subsequent rebound (Feb 6) saw demand participation but failed to sustain. Recent low-volume, narrow consolidation, combined with price being in a key support zone, aligns with the price-volume characteristics of "supply drying up and temporary balance between buyers and sellers within an Accumulation range". The current primary conflict is: Can demand re-emerge and overpower the remaining supply when price tests support?

3. Volatility and Market Sentiment

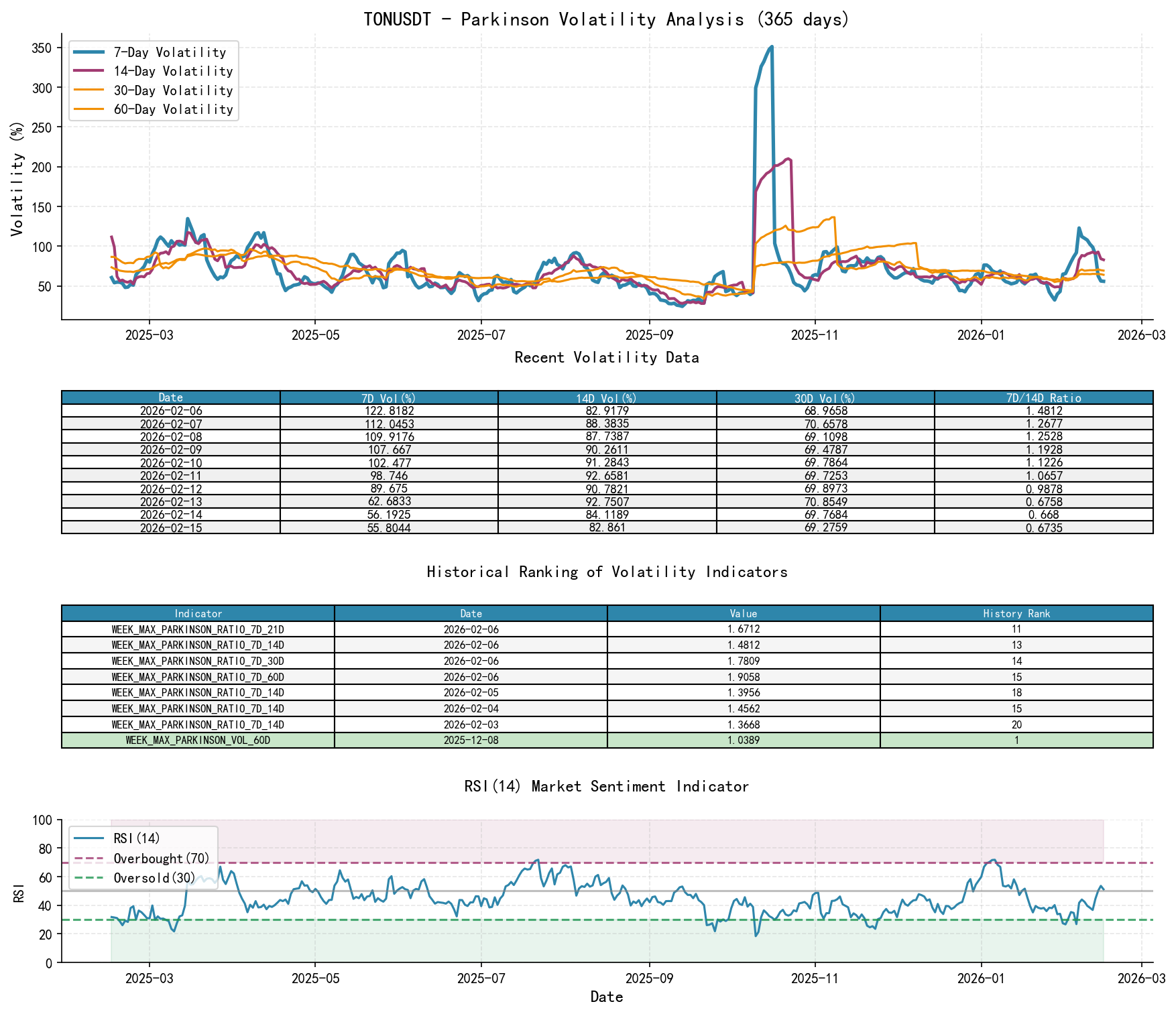

As of 2026-02-15, the subject TONUSDT recorded: Open 1.50, 7-day Intraday Volatility 0.56, 7-day Intraday Volatility Ratio 0.67, 7-day Historical Volatility 0.68, 7-day Historical Volatility Ratio 0.74, RSI 51.16.

Data Derivation:

- • Volatility Level and Change: Recent Historical Volatility (HIS_VOLA) and Parkinson Volatility have experienced sharp fluctuations. The 7-day volatility peaked (>1.0) in early February, far above the 60-day volatility (approx. 0.65).

- • Volatility Ratio (RATIO): On 2026-02-06, HIS_VOLA_RATIO_7D_60D reached 1.946 (ranking 13th), and PARKINSON_RATIO_7D_60D reached 1.906 (ranking 15th). These extreme ratios confirmed that short-term panic sentiment reached historically rare levels. Currently (Feb 15), these ratios have significantly fallen back to 1.02 and 0.87, indicating that short-term volatility is rapidly converging towards the long-term norm, with panic sentiment notably easing.

- • RSI Sentiment Indicator: RSI_14 rapidly declined from the overbought extreme in early January (>70, near historical highs) to the oversold region (<30) by late January. The current RSI_14 is 51.16, in the neutral zone, indicating that extreme one-sided sentiment has been corrected, and market sentiment has returned to balance.

Wyckoff Principle Interpretation:

The rapid convergence of volatility from extreme panic levels (high ratios) to normalcy is a typical feature of the market transitioning from a "downtrend" or "panic selling" phase to a "consolidation/accumulation" phase. The RSI's journey from overbought to oversold and back to neutral completes a full sentiment cycle. This supports the judgment that the market may be forming a stage bottom.

4. Relative Strength and Momentum Performance

Data Derivation:

- • Return Analysis:

- • Short-term (WTD): The weekly return as of Feb 15 is 5.07%, showing short-term rebound momentum, but this has not yet altered the weekly downtrend structure.

- • Medium-term (MTD/QTD): The return since February is 8.80%, but the quarterly return (QTD) remains -11.33%, indicating that despite the February rebound, overall momentum for the quarter is still weak.

- • Long-term (YTD): The year-to-date return is -11.33%, confirming the asset's relative weakness over a longer timeframe.

- • Momentum Validation: The recent rebound momentum (positive WTD, MTD) has been confirmed by the price-volume action of the high-volume bullish candle on Feb 6. However, medium-to-long-term momentum indicators (negative QTD, YTD) corroborate with the bearishly aligned moving average system, indicating any rally can currently only be defined as a rebound within a downtrend, not a trend reversal.

5. Large Investor ("Smart Money") Behavior Identification

Data Derivation and Inference:

Based on Wyckoff theory and the aforementioned price-volume and volatility analysis, inferences about smart money intent are as follows:

- 1. Distribution Phase (Early-mid January 2026): During the price surge to the 1.90+ zone, accompanied by extremely high RSI and high-volume stagnation, smart money was likely distributing their holdings to the market, transferring positions to retail traders chasing the highs.

- 2. Accumulation During Panic Selling (Jan 31, 2026): When price crashed to the 1.25-1.35 zone, record-breaking volume occurred (trading volume ranking among the highest historically). This is highly likely smart money utilizing public panic sentiment for massive accumulation. The public sells out of fear, while large investors demand.

- 3. Current Behavior (Accumulation Range Formation): Price consolidates in a narrow range on low volume near lows, with volatility converging. Smart money may be using the narrow oscillation to continue accumulating while testing the remaining supply pressure in the market. The low-volume minor decline on Feb 15 can be interpreted as a test of floating supply, which did not trigger new panic selling, suggesting supply may be exhausting.

Core Judgment: The operational trajectory of smart money shows a clear pattern of "Distribution at highs -> Massive accumulation at panic lows -> Continued accumulation during low-level consolidation". The current focus is on whether their accumulation behavior is nearing completion and when they might begin upward testing to break away from the cost zone.

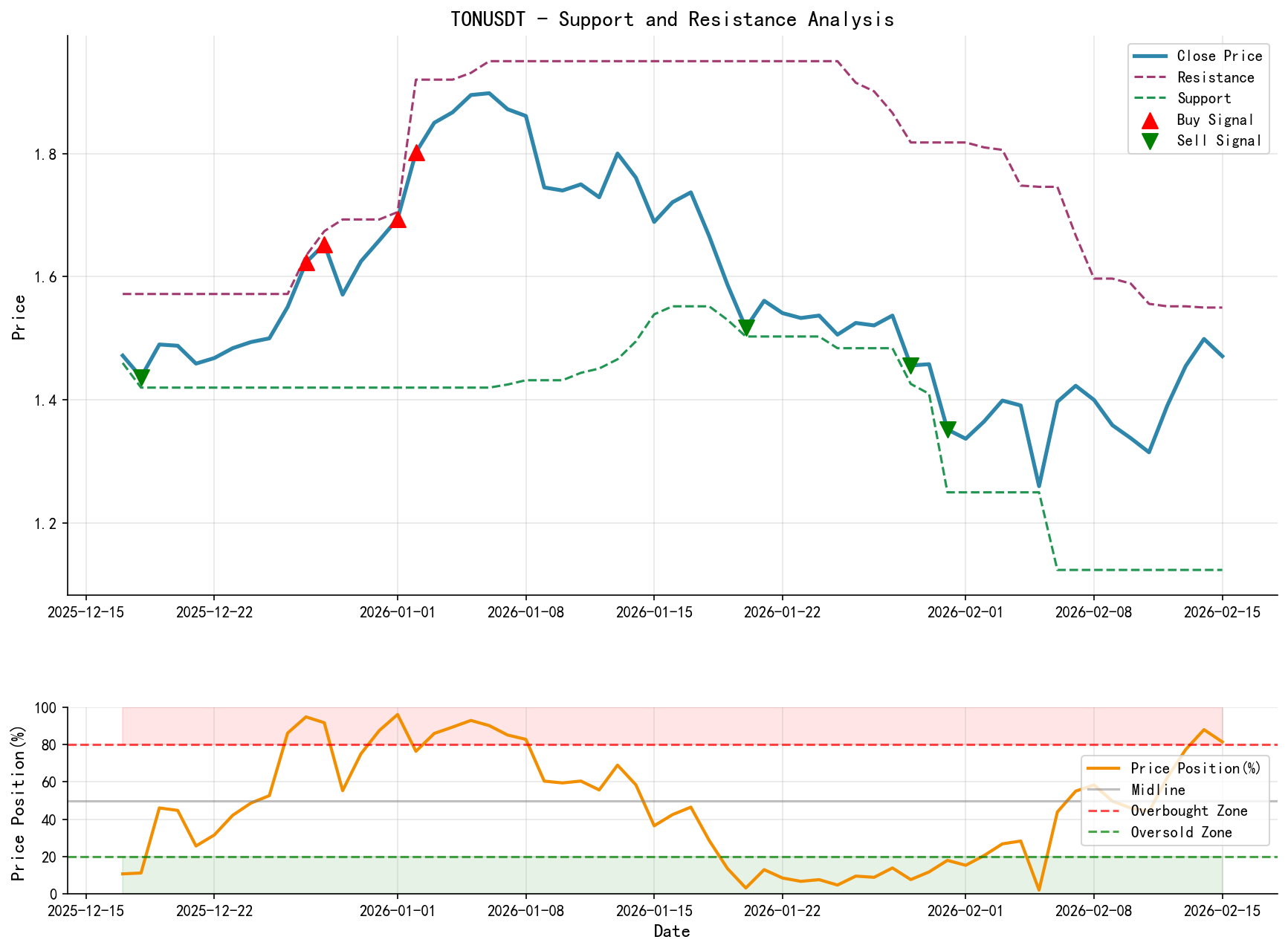

6. Support/Resistance Level Analysis and Trading Signals

Key Price Levels:

- • Strong Support: 1.260 - 1.315. This is a confluence zone formed by recent panic selling lows (Feb 5, 6) and secondary test lows (Feb 11, 12). A break below this zone would negate the potential accumulation structure, opening new downside.

- • Near-term Resistance/Supply Zone: 1.500 - 1.550. This is the high area of the mid-February rebound and the lower edge of a minor consolidation platform during the previous decline. Breaking above this zone is the first signal of demand returning and price potentially moving towards higher resistance (1.650-1.700).

- • Major Resistance: 1.800 - 1.900. The lower edge of the early January distribution range serves as the medium-to-long-term demarcation line.

Comprehensive Trading Signals and Operational Recommendations:

Based on Wyckoff event analysis, the current market shows signs of the "left side of a potential accumulation structure".

- 1. Signal Nature: Observe / Cautiously Bullish on Rebound. Await confirmation from clearer Wyckoff buy structures (e.g., a successful secondary test followed by a rally on high volume).

- 2. Operational Recommendations:

- • Long Strategy (Higher risk, requires strict confirmation):

- • Entry Condition: Price stabilizes within the 1.260-1.340 support zone and shows signs of "breaking above 1.500 on high volume", which could serve as a preliminary entry signal. A stronger signal would be price retracing to near 1.40 and stabilizing on low volume (a successful secondary test).

- • Stop Loss: Place below 1.250, i.e., below the panic low.

- • Initial Target: 1.650 - 1.700 (previous rebound highs during the decline and moving average resistance).

- • Short Strategy (Following the primary trend):

- • Entry Condition: Price rallies to the 1.530 - 1.550 resistance zone and shows signs of stalling (e.g., long upper wick, low volume) or directly breaks below the 1.315 support on volume.

- • Stop Loss: Place above 1.560 (a break above the recent consolidation range high).

- • Target: Downside to 1.260, with lower targets upon a break.

- • Long Strategy (Higher risk, requires strict confirmation):

- 3. Future Validation Points (Require Close Monitoring):

- • Confirmation Signal: Price within the support zone (1.26-1.34) exhibits a combination of "low-volume narrow consolidation -> sudden high-volume rally (Spring)", with significantly increased volume.

- • Invalidation Signal: Price fails to rally convincingly, remains persistently suppressed below 1.50, and eventually breaks below 1.260 on volume. This would signify accumulation failure, supply regaining market dominance, and a continuation of the downtrend.

Summary: TONUSDT has experienced a complete cycle of Distribution-Markdown-Panic. Current data suggests that a process of accumulation, likely led by large investors, may have begun in the extreme low-price region, and the market is in a critical phase of potentially forming a bottom. Traders should focus on the defensive status of the 1.26-1.34 support zone and the price's reaction to testing the 1.50-1.55 resistance zone, making decisions based on corresponding Wyckoff price-volume events.

Disclaimer: The content of this report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding its accuracy or completeness. Markets involve risks, and investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff price-volume market interpretations are released daily at 08:00 before the market opens. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's work together to identify market signals.

Member discussion: