Understood. I will provide an in-depth quantitative analysis report on DOGEUSDT centered around the Wyckoff method. All conclusions are derived from the provided data and strictly adhere to the six dimensions you specified.

Wyckoff Quantitative Analysis Report: DOGEUSDT

Product Code: DOGEUSDT

Analysis Date Range: 2025-12-17 to 2026-02-15

Report Generation Time: 2026-02-16

1. Trend Analysis & Market Phase Identification

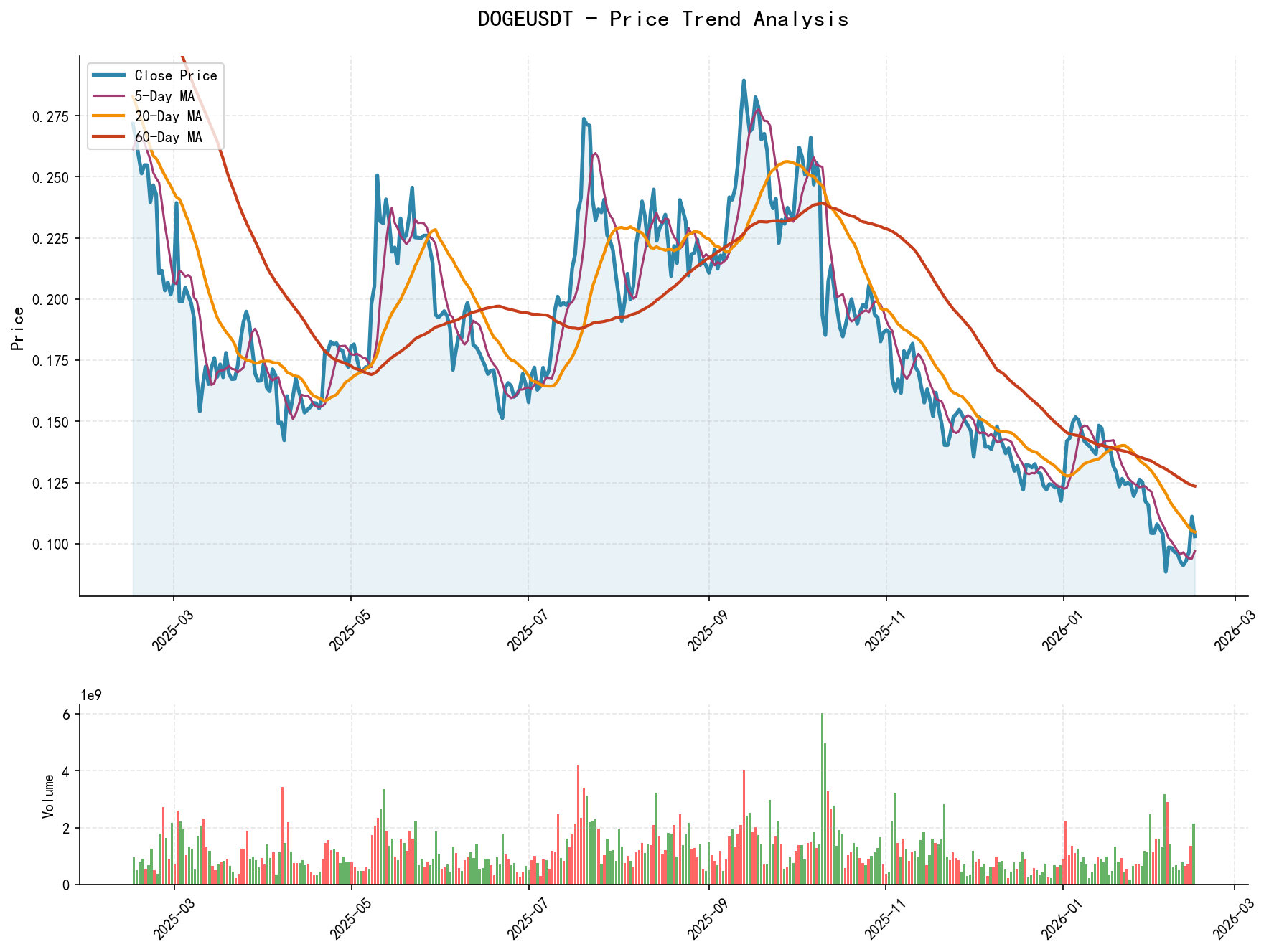

As of February 15, 2026, for the subject DOGEUSDT: opening price 0.11, closing price 0.10, 5-day moving average 0.10, 10-day moving average 0.10, 20-day moving average 0.10, daily change -7.29%, weekly change +6.54%, monthly change -1.26%, quarterly change -12.36%, yearly change -12.36%.

- • Moving Average Alignment & Trend Assessment:

- • As of the final day of the analysis period (2026-02-15), the price (CLOSE: 0.10295) has fallen significantly below all major moving averages (MA_5D: 0.09692, MA_10D: 0.096254, MA_20D: 0.1047735, MA_30D: 0.1125, MA_60D: 0.12348917), presenting a fully bearish alignment pattern.

- • Wyckoff Interpretation: The price has been in a Primary Downward Trend for an extended period, and the Intermediate Trend has also clearly turned downward. The MA_60D, as a long-term trend line, continues to decline, indicating a solid bearish structure. The market is in a phase of "Automatic Rally" or secondary rally attempt following a "Panic Decline".

- • Market Phase Identification:

- • Early Data Period (December 2025) to early January 2026: After a prolonged decline, a significant rally occurred from January 1-6, 2026 (from 0.11747 to 0.15055), accompanied by a sharp spike in volume. According to Wyckoff theory, this can be viewed as an Automatic Rally (AR) within a downtrend or a potential sign of Accumulation at an absolute bottom area. However, the subsequent price failed to make a higher high, and the rally quickly lost momentum.

- • Mid-January 2026 to Present: After fluctuating below 0.15, Panic Selling occurred around early February (Feb 5-6), with a sharp price drop to a new low (0.08675) on historically high volume. A rapid bounce followed. Considering the current price action (renewed high-volume decline after the bounce), the market may be transitioning from the Panic phase into a "Secondary Test" or "Shakeout" phase, aiming to test the absorption strength at the panic lows and prepare for either a potential new down leg (if the test fails) or a basing process (if the test succeeds).

2. Volume-Price Relationship & Supply-Demand Dynamics

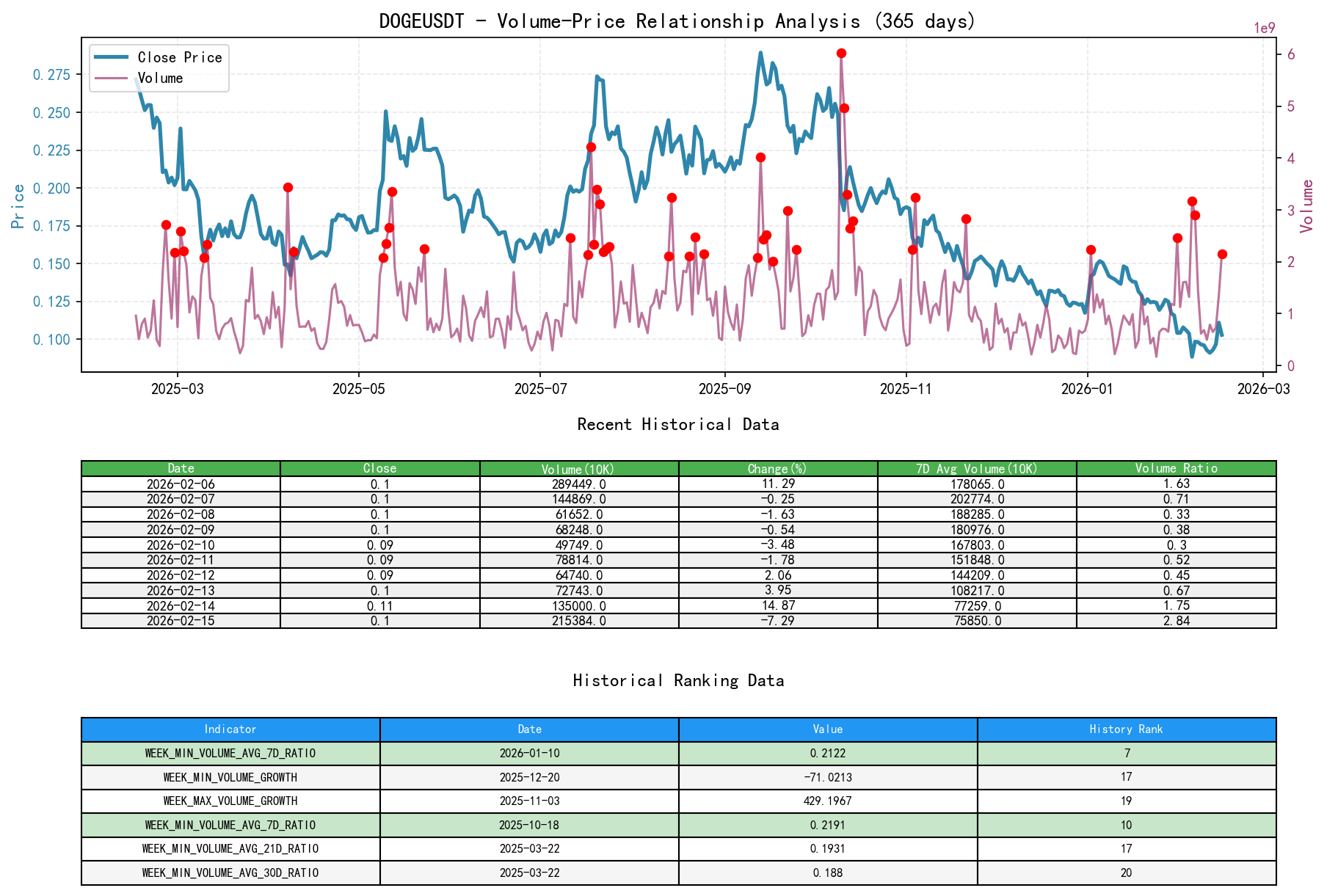

As of February 15, 2026, for the subject DOGEUSDT: opening price 0.11, closing price 0.10, volume 2153840157.00, daily change -7.29%, volume 2153840157.00, 7-day average volume 758500029.14, 7-day volume ratio 2.84.

- • Key Days & Supply-Demand Transition Analysis:

- 1. Panic Selling (Overwhelming Supply Dominance): 2026-02-05 was a textbook panic day. The price plunged -14.77% on a single day, with volume surging to 3.17B, which is 2.11 times (

VOLUME_AVG_7D_RATIO) the 7-day average volume (AVERAGE_VOLUME_7D). Massive volume accompanying a price crash indicates a climax in supply (selling pressure) and a breakdown in market sentiment. - 2. Demand Attempts to Enter (Initial Support): On 2026-02-06, the price rebounded +11.29% while volume remained high at 2.89B (1.63 times the 7-day average). This high-volume rally suggests significant buying (demand) actively intervened near the panic low, attempting to halt the decline. This is the first positive sign of demand emergence.

- 3. Rally Meets Resistance & Supply Reappears: The combination of 2026-02-14 and 2026-02-15 is key to judging the current phase.

- • Feb 14: Price surged +14.87% on volume of 1.35B (1.75 times the 7-day average), indicating strong demand.

- • Feb 15: Price failed to continue rising, instead falling -7.29%, but volume expanded further to 2.15B (2.84 times the 7-day average,

VOLUME_AVG_7D_RATIO). High-volume decline at a higher price level is a clear signal of Supply Coming In. This indicates the Feb 14 rally attracted fresh selling; demand failed to fully absorb the supply, and upward momentum was checked.

- 4. Historical Extremes Confirmation: In the data, the

VOLUME_AVG_7D_RATIOon 2026-01-10 (0.2122) ranks as the 7th lowest in nearly a decade, corresponding to extreme low volume during a period of gradual decline, indicating a temporary waning of downward momentum but no demand entry. This starkly contrasts with the subsequent high-volume crash, highlighting the extremity of recent volume fluctuations.

- 1. Panic Selling (Overwhelming Supply Dominance): 2026-02-05 was a textbook panic day. The price plunged -14.77% on a single day, with volume surging to 3.17B, which is 2.11 times (

- • Supply-Demand Conclusion:

- • The market experienced a panic supply climax in the 0.086 - 0.09 range, which triggered a demand attempt.

- • However, upon rebounding to the 0.117 vicinity, it encountered strong supply resistance (evidenced by the Feb 15 high-volume decline).

- • The current supply-demand structure is: preliminary demand support formed by panic below, with a clear supply pressure zone above. The market is at a critical juncture of buyer-seller contention.

3. Volatility & Market Sentiment

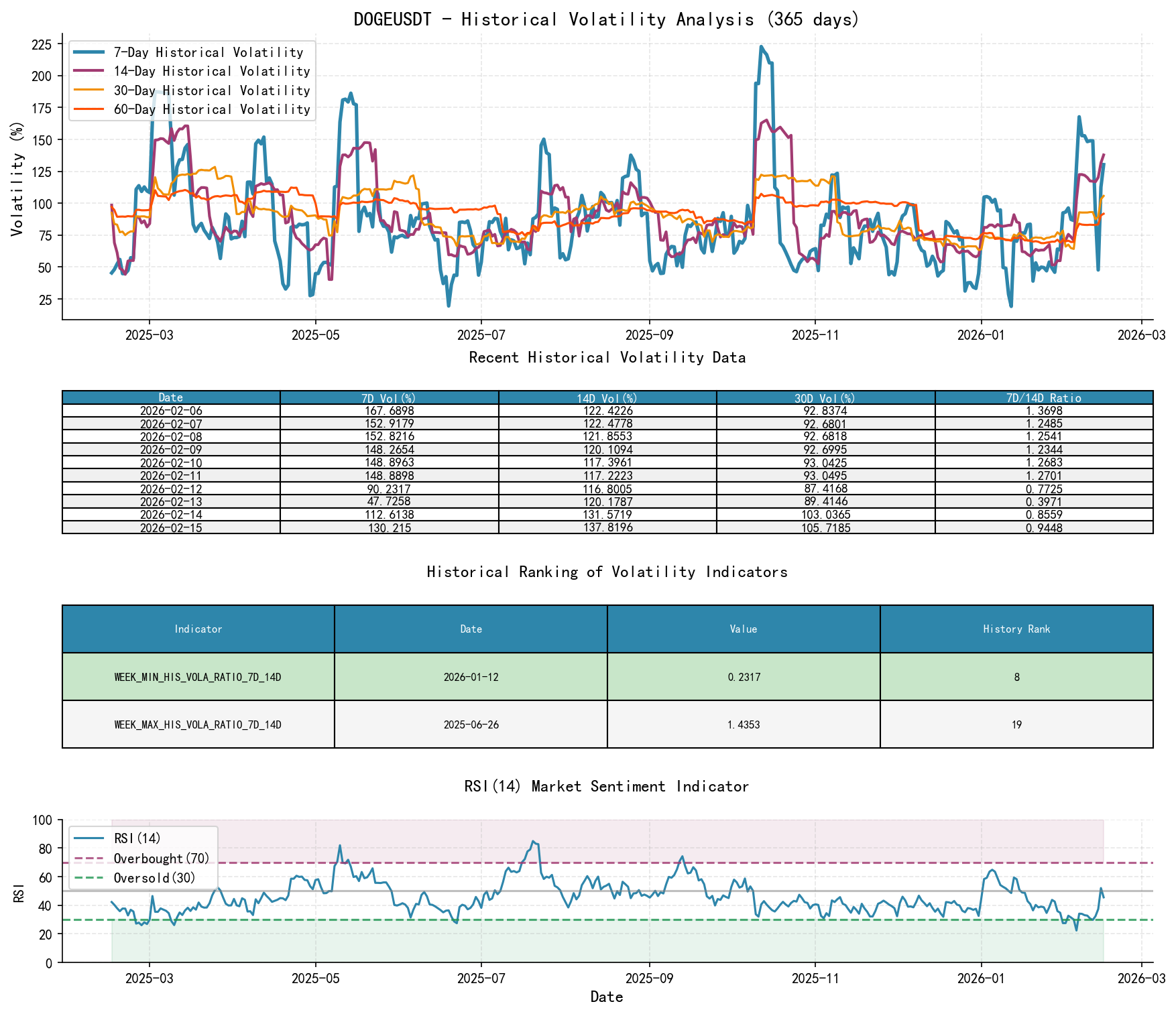

As of February 15, 2026, for the subject DOGEUSDT: opening price 0.11, 7-day intraday volatility 0.95, 7-day volatility-volume ratio 0.85, 7-day historical volatility 1.30, 7-day historical volatility-volume ratio 0.94, RSI 45.57.

- • Volatility Analysis:

- • Both Historical Volatility (HIS_VOLA) and Parkinson Volatility peaked in early February 2026. For instance,

HIS_VOLA_7Dreached 1.6769 on Feb 6, andPARKINSON_VOL_7Dreached 1.5611 on Feb 6. This confirms the market entered a high-volatility panic state around Feb 5. - • Volatility Ratios: The

HIS_VOLA_RATIO_7D_14DandPARKINSON_RATIO_7D_14Dwere generally above 1 during and after the panic days (e.g., 1.2545 and 1.4083 respectively on Feb 5), indicating short-term volatility far exceeded medium-term volatility, a typical feature of trend acceleration or extreme sentiment. - • Historical Ranking Confirmation: The

HIS_VOLA_RATIO_7D_14Dvalue of 0.2317 on 2026-01-12 ranks as the 8th lowest in nearly a decade, corresponding to a low-volatility "dead calm" state during a downtrend consolidation. This provides context for the subsequent volatility explosion (panic).

- • Both Historical Volatility (HIS_VOLA) and Parkinson Volatility peaked in early February 2026. For instance,

- • Market Sentiment (RSI):

- • RSI_14 touched 22.36 on 2026-02-05, which, according to historical ranking data, is the second lowest extreme in nearly a decade. This indicates extreme oversold conditions from a momentum perspective, technically supporting a bounce.

- • As of Feb 15, RSI has recovered to 45.57, moving out of the oversold zone but not entering overbought territory, suggesting sentiment has recovered from panic but is not overheated.

- • Sentiment & Volatility Conclusion:

- • The market has experienced a complete sentiment cycle: "Low-volatility gradual decline" -> "High-volatility panic" -> "Sentiment recovery bounce".

- • Current volatility remains relatively high (

HIS_VOLA_7D: 1.3022). Combined with the RSI level, this indicates market sentiment is still unstable, caught between "recovery" and "hesitation", and is highly susceptible to renewed volatility from any new supply-demand shifts.

4. Relative Strength & Momentum Performance

- • Periodic Return Analysis:

- • Short-term Momentum (WTD_RETURN): Highly volatile, with the weekly return reaching +13.04% on Feb 14 but retracting to +6.54% by the 15th, indicating rally momentum weakened towards the weekend.

- • Medium-term Momentum (MTD_RETURN, QTD_RETURN, YTD): All negative (MTD: -1.26%, QTD/YTD: -12.36%), indicating that from a medium-term (monthly, quarterly) perspective, the asset remains in significant relative weakness.

- • Long-term Momentum (TTM_12, TTM_24): The TTM_12 return is -62.11%, confirming a year-long bear market. TTM_24 is positive (+20.72%) but has been significantly eroded by the past year's decline.

- • Momentum & Volume-Price Verification:

- • The short-term momentum bounce (positive WTD) aligns with the high-volume rally on Feb 14, while the momentum decay perfectly coincides with the high-volume decline on Feb 15.

- • The persistently negative medium-term momentum validates the conclusion that the price is suppressed below all major moving averages (bearish alignment).

5. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff principles and the above volume-price analysis, the inferred intent of smart money is as follows:

- 1. Accumulation During Panic: The massive exchange of volume on Feb 5-6 (panic selling + high-volume bounce) is a classic smart money scenario. It can be inferred that some large capital engaged in panic buying (Buying Climax of a downtrend) within the 0.086-0.098 range, absorbing panic selling from retail investors. This does not signify an immediate reversal but rather the establishment of an initial position.

- 2. Distribution or Pressure Testing During the Rally: The high-volume decline near 0.117 on Feb 15 is a critical signal. Two interpretations are possible:

- • Distribution: Smart money utilized the strong rally on Feb 14 to distribute shares accumulated at lower prices to buyers chasing the high.

- • Test of Supply: Smart money intentionally tested the strength of overhead supply. The heavy-volume decline indicates supply remains substantial, and the market is not yet ready for a bull run. Consequently, smart money may pause buying or even initiate short positions.

- 3. Current Phase Assessment: Smart money likely engaged in selective accumulation at lower levels but has not propelled a strong V-shaped reversal. They are using the rally to test the market structure. The Feb 15 candlestick is a strong instance of "Stopping Action" — the advance was halted. This suggests smart money perceives supply at current price levels (above 0.11) as too heavy for an immediate markup; the market requires more time for Re-accumulation at lower levels or to undergo a Secondary Test.

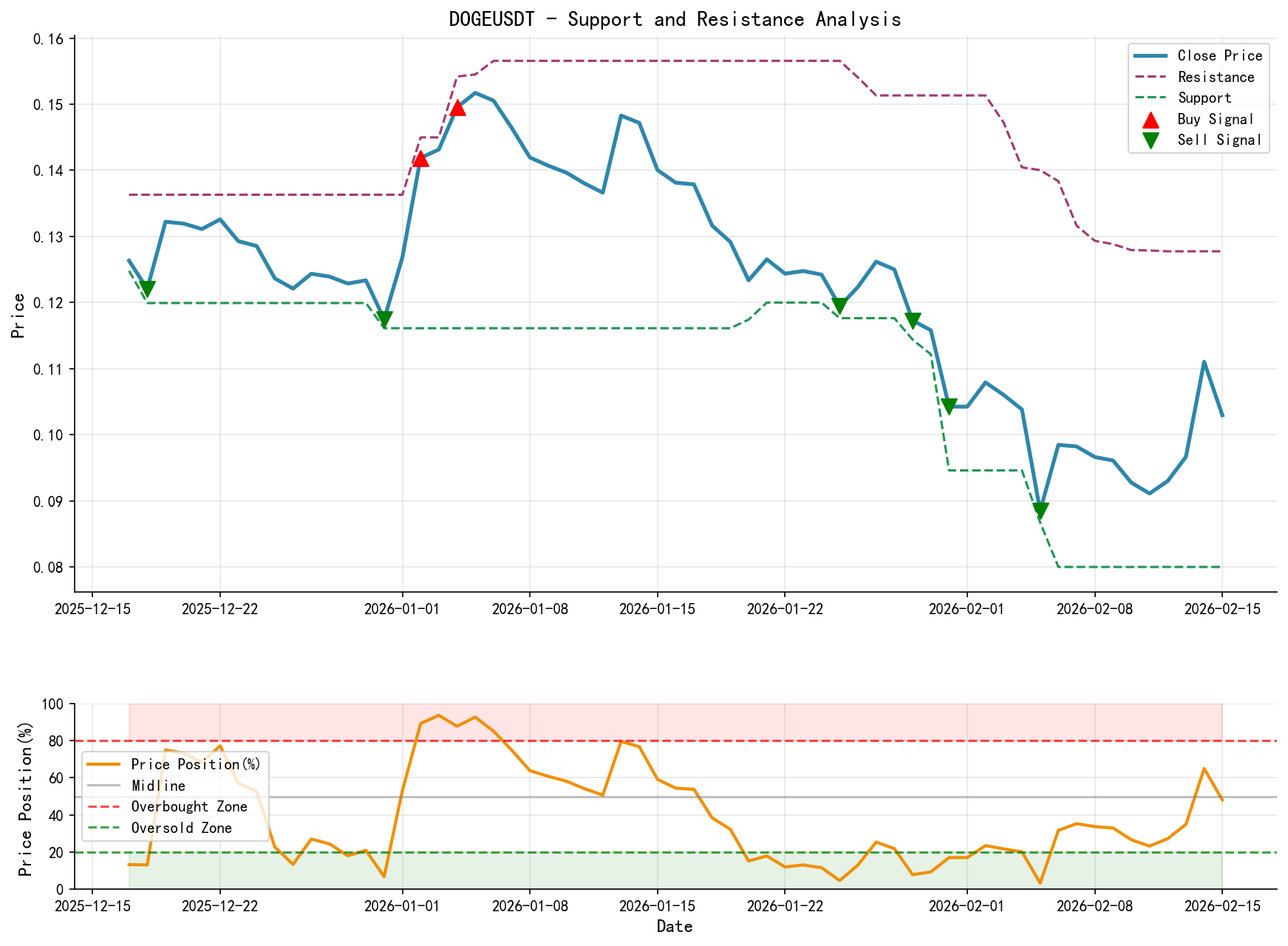

6. Support/Resistance Level Analysis & Trading Signals

- • Key Support Levels:

- • S1 (Strong Support / Panic Bottom): 0.08675 (2026-02-06 LOW). This is the recent panic selling low, the area where demand first appeared on a large scale.

- • S2 (Minor Support): 0.09461 (2026-02-01 LOW) and 0.09848 (2026-02-06 CLOSE). This is the range of the first bounce platform following the panic.

- • Key Resistance Levels:

- • R1 (Immediate Supply Zone): 0.11104 - 0.11757 (2026-02-14 HIGH / 2026-02-15 HIGH). This area exhibited a clear high-volume decline and is the current core supply zone.

- • R2 (Structural Strong Resistance): 0.12683 (2026-01-01 LOW & previous multiple rally highs). A break above this level is required to initially alter the downtrend structure.

- • Wyckoff Integrated Trading Signal:

- • Primary Signal: Bearish / Wait-and-See. The core rationale is the "supply overwhelming demand" signal (high-volume decline at a higher level) on Feb 15, coupled with the price being below all moving averages.

- • Market Phase: In a Secondary Test / Re-accumulation phase following a panic decline. The trend has not reversed.

- • Operational Suggestions & Validation Points:

- 1. Bearish Strategy (Trend-following): If price rallies but fails to decisively break above and hold R1 (0.117), or if another low-volume rally occurs into this zone, it could be considered a shorting opportunity. Stop-loss set above R1 at 0.120. Targets look towards S2 (0.095) and S1 (0.087).

- 2. Bullish Observation (Contrarian Probe): Aggressive long positions are not currently recommended. If price retraces near S1 (0.087) and shows clear signs of low-volume stabilization (e.g., a very small-bodied candlestick with a sharp drop in volume), aggressive traders may attempt a light long position with a stop-loss below 0.085. This bets on a successful secondary test forming a double bottom.

- 3. Key Validation Points (Future Observation Required):

- • Bullish Validation: Price needs to break above R2 (0.127) with volume (moderate increase) and hold on a pullback to confirm a potential shift in the downtrend, entering the late stages of accumulation.

- • Bearish Validation: Price breaking below S1 (0.087) on high volume would confirm the secondary test failed, the panic low is breached, and the market would enter a new down leg (potentially seeking support in the 0.07-0.08 area).

Conclusion Reiterated: Based on Wyckoff volume-price analysis, DOGEUSDT is in a secondary rally phase within a primary downtrend, with a clear signal of supply overwhelming demand appearing near recent rally highs (~0.117). Large investors exhibited accumulation behavior at panic lows but currently show no strong intent to drive prices higher; instead, they are testing overhead resistance. The primary recommended strategy is selling rallies or adopting a wait-and-see approach, awaiting a clearer directional commitment from the market at key support (0.087) or resistance (0.127) levels. All assessments are derived from data; the final outcome must be validated by actual market-generated supply and demand.

Disclaimer: This report/interpretation is solely for market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantee regarding accuracy or completeness. Markets involve risks, and investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Interpretations are published daily at 8:00 before the market opens. Your feedback and shares are greatly appreciated. Your recognition is crucial. Let's observe market signals together.

Member discussion: