Understood. In accordance with your instructions, as a quantitative trading researcher specializing in the Wyckoff Method, I will author a comprehensive and in-depth quantitative analysis report based on the provided BNBUSDT daily data (2025-12-17 to 2026-02-15) and historical ranking data. All conclusions are strictly derived from the data, adhering to Wyckoff's principles of price and volume.

BNBUSDT Quantitative Analysis Report (Based on the Wyckoff Method)

Product Code: BNBUSDT

Analysis Date Range: December 17, 2025 - February 15, 2026

Report Generation Time: February 16, 2026

Executive Summary:

During the analysis period, BNBUSDT experienced a complete market cycle, evolving from high-level distributional oscillation (December 2025) to a trending decline (January 2026), culminating in a panic-driven crash (late January to February 2026). The current market (as of 2026-02-15) is in the initial stabilization phase following panic selling, showing signs of extreme oversold conditions, high volatility, and potential supply exhaustion. Historical ranking data indicates that recent volatility, volume ratios, and oversold metrics are at extreme levels relative to the past decade, suggesting the market is undergoing a significant structural inflection point.

Dimension One: Trend Analysis and Market Phase Identification

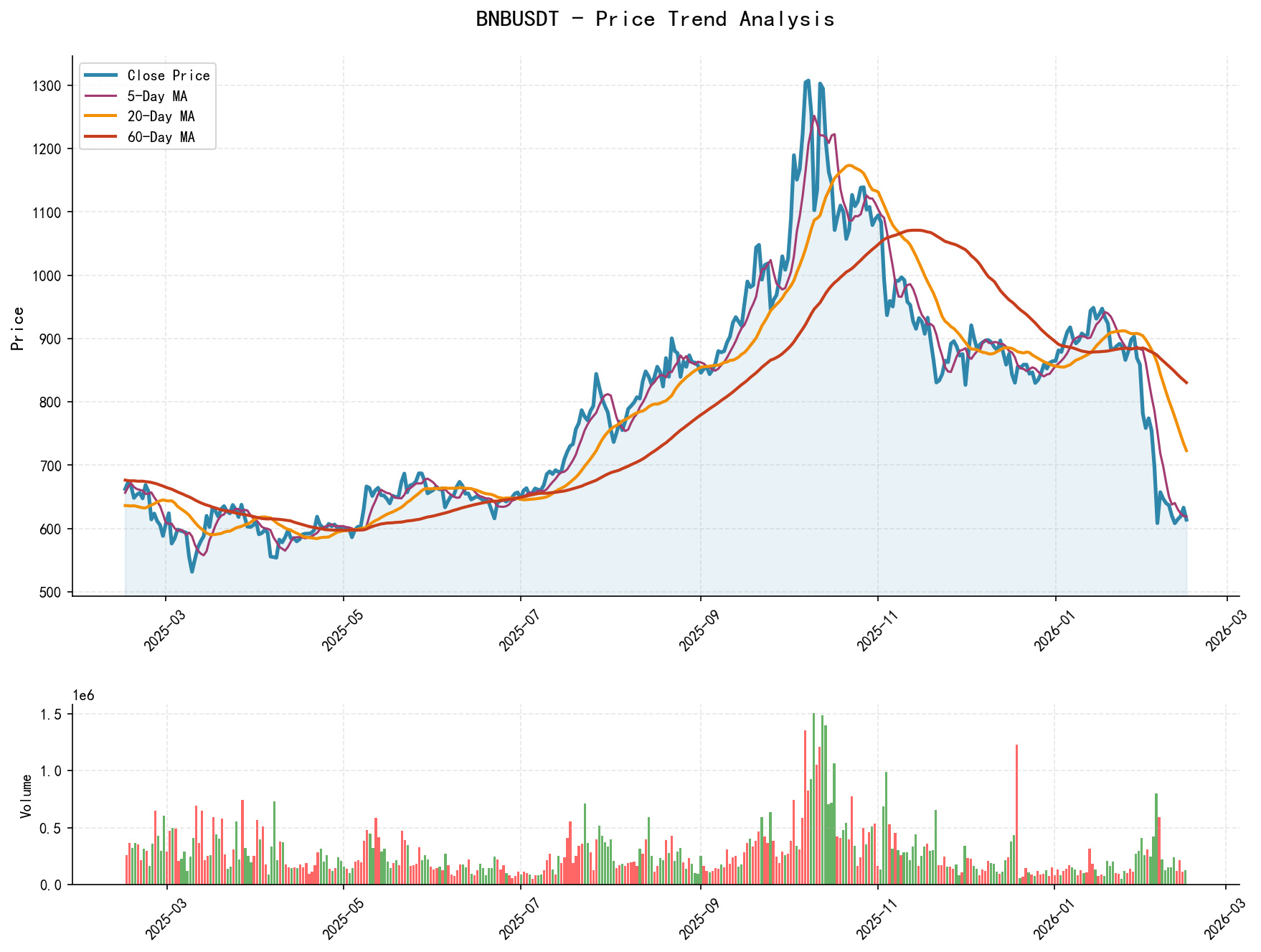

As of 2026-02-15, the subject BNBUSDT opened at 632.77, closed at 613.73, with moving averages: MA_5D at 618.79, MA_10D at 628.28, MA_20D at 722.84. Performance metrics: Daily change -3.01%, Weekly change -4.09%, Monthly change -21.46%, Quarterly change -28.99%, Year-to-Date change -28.99%.

- 1. Trend Structure:

- • Moving Average Alignment: Throughout the analysis period, a bearish alignment (MA_5D < MA_10D < MA_20D < MA_30D < MA_60D) has been the dominant characteristic. Since MA_5D crossed below MA_60D in mid-January 2026, the long, medium, and short-term moving averages have persistently shown bearish divergence, signaling a clearly defined primary downtrend.

- • Price vs. Moving Averages: The price remained below all major moving averages for the vast majority of the period. Especially after February, the price deviated sharply from the moving average system, exhibiting a "waterfall decline," characteristic of an accelerating bear market phase.

- 2. Market Phase Evolution:

- • December 2025 - Mid-January 2026 (High-Level Distribution Phase): Price oscillated widely within the 875-950 range. Multiple instances of "high-volume churning" (e.g., 2026-01-03: price down -0.30%, volume 1.7x recent average) and "high-volume decline" (e.g., 2026-01-19: down -0.96%, volume 1.57x the 14-day average) occurred. This is typical "distribution" behavior in Wyckoff theory, where large capital transfers holdings to retail traders at relatively high levels.

- • Late January - Early February 2026 (Decline and Panic Phase): After breaking below the lower boundary (~880-900) of the distribution range, the decline accelerated. Entering February, the market experienced panic selling. On 2026-02-05, the price plunged -12.76% on a volume spike to 3.82x the 14-day average, ranking as the 17th highest Volume Ratio over the past decade, confirming the occurrence of a Selling Climax (SC).

- • Current Phase (2026-02-15, Post-Panic Testing): Following the crash, the price consolidated in the 600-650 zone. On February 15th, the price fell -3.01%, but volume was only 0.44x the 14-day average, indicating a significant weakening of downward momentum (supply) compared to the panic period. The market may be entering the "Automatic Rally" (AR) or "Secondary Test" (ST) phase, seeking a supply-demand balance after panic liquidation.

Dimension Two: Volume-Price Relationship and Supply-Demand Dynamics

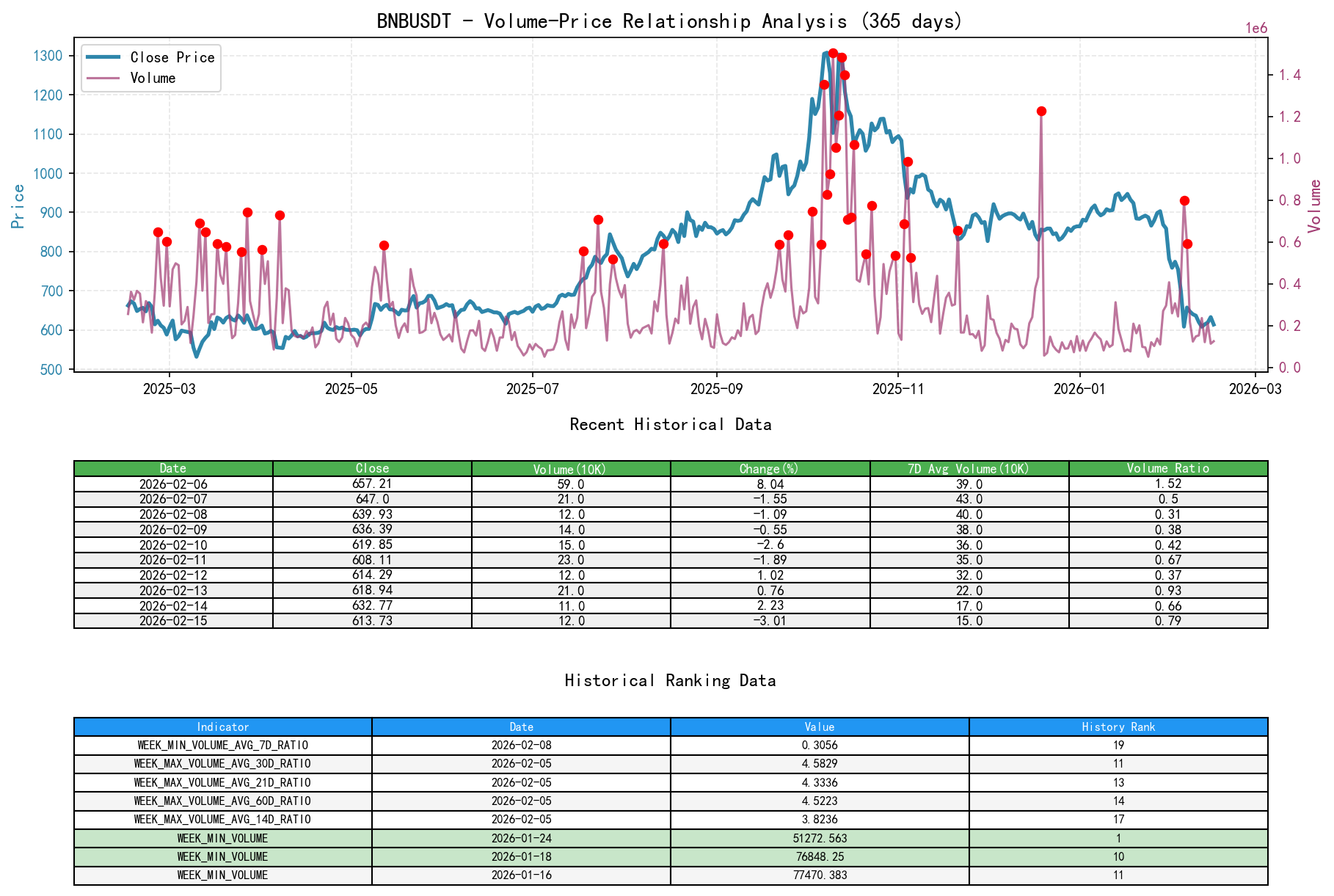

As of 2026-02-15, the subject BNBUSDT opened at 632.77, closed at 613.73, volume 125553.88, daily change -3.01%, volume 125553.88, 7-day average volume 158484.05, 7-day volume ratio 0.79.

- 1. Key Volume-Price Signals:

- • Distribution Signal (Supply Dominated): On

2025-12-19, the price rose 3.14%, but the volume/14-day average ratio was 6.54, ranking 2nd in the past decade. This is a classic "Upthrust" – massive buying effort being absorbed by even stronger supply (selling), foreshadowing a top. The following day,2025-12-20, volume plummeted -95.35% (historical rank 2nd), indicating rapid buying exhaustion. - • Panic Selling Signal (Supply Exhaustion): On

2026-02-05, the price crashed -12.76% with a volume/14-day average ratio of 3.82 (historical rank 17) and a volume/60-day average ratio of 4.52 (historical rank 14). Extremely high volume on a decline indicates panic-driven selling by retail traders. In Wyckoff theory, this is characteristic of "Panic Selling," often a signal of a decline's final stages. - • Lack of Demand Signal: On

2026-01-24, the price declined slightly by -0.50% on extremely low volume of 51272 (historical rank 1 lowest), with a volume/7-day average ratio of only 0.38. An extremely low-volume decline within a downtrend shows weak demand but also temporarily exhausted supply, leading to a lack of market direction. - • Current Supply-Demand State: On

2026-02-15, the price decline was accompanied by contracting volume (volume/14-day average ratio 0.44). Given the context of a significant prior price drop, this preliminarily constitutes a sign of "Stopping Volume," meaning panic selling has substantially diminished. A trend reversal would now require new demand entering the market.

- • Distribution Signal (Supply Dominated): On

Dimension Three: Volatility and Market Sentiment

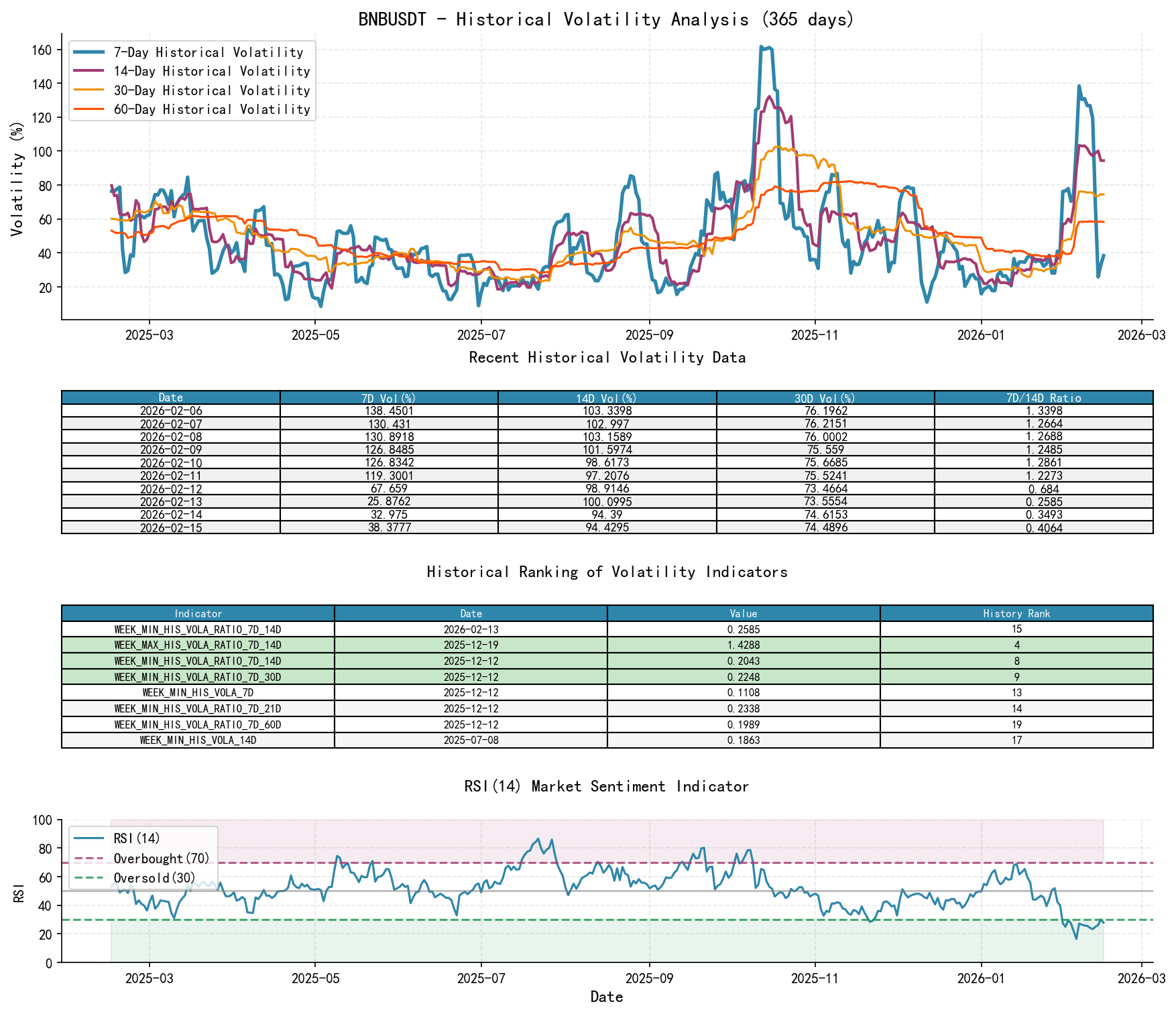

As of 2026-02-15, the subject BNBUSDT opened at 632.77, 7-day intraday volatility 0.53, 7-day intraday volatility ratio 0.67, 7-day historical volatility 0.38, 7-day historical volatility ratio 0.41, RSI 27.89.

- 1. Volatility Levels:

- • Extreme Spike: Entering February 2026, short-term volatility (7-day, 14-day) exploded. On

2026-02-06, the 7-day Parkinson Volatility reached 1.245, and the 7-day/14-day Parkinson Volatility ratio reached 1.559, ranking 8th highest in the past decade. The 7-day Historical Volatility reached 1.384, with a 7-day/60-day volatility ratio of 2.373. This fully confirms the market was in a state of extreme panic and irrationality. - • Current State: As of

2026-02-15, short-term volatility (7-day Parkinson 0.533, Historical Volatility 0.384) has retreated from its peak but remains significantly higher than long-term (60-day) volatility (ratios >1). Market sentiment is transitioning from "extreme panic" to "high-volatility anxiety."

- • Extreme Spike: Entering February 2026, short-term volatility (7-day, 14-day) exploded. On

- 2. Overbought/Oversold (RSI):

- • Deeply Oversold: On

2026-02-05, RSI_14 dropped to 16.46, ranking 5th lowest in the past decade, confirming that market sentiment reached an extreme pessimistic climax. A subsequent bounce brought RSI back near 30, but by2026-02-15it had fallen again to 27.89, still in a severely oversold zone. This indicates that despite a bounce, overall sentiment remains fragile.

- • Deeply Oversold: On

Dimension Four: Relative Strength and Momentum Performance

- • Momentum Collapse: Returns across all timeframes are deeply negative.

WTD_RETURN(weekly) andMTD_RETURN(monthly) remained negative throughout February.QTD_RETURN(quarterly) is -28.99%, andYTD(year-to-date) return is -28.99%. This confirms that BNB has been extremely weak relative to its own prior performance during the analysis period, with medium and long-term momentum strongly negative, showing no signs of strength.

Dimension Five: Large Investor ("Smart Money") Behavior Identification

Based on volume-price and volatility data, the intentions of large investors can be inferred as follows:

- 1. Distribution Period (Dec 2025 - Jan 2026): Large capital utilized high-level oscillation and intermittent rallies to distribute holdings to retail traders chasing the rise. High-volume churning days (e.g., 2025-12-19) are clear traces of institutional selling.

- 2. Leading the Decline and Shaking Out (Jan 2026): After breaking the distribution range, the decline was accompanied by intermittent volume spikes, possibly indicating continued selling by large players or their use of the drop to flush out remaining long leverage (shaking out).

- 3. Potential Accumulation During Panic (Feb 2026): The extremely high-volume decline on

2026-02-05and subsequent days is classic "Panic Selling." Wyckoff theory posits that discerning capital ("smart money") may begin accumulating panic-driven selling in tranches during such events. While not directly provable, the massive volume implies a powerful counterparty absorbed all panic selling, which is often characteristic of institutional activity. - 4. Current Observation/Testing: The rapid volume contraction after the crash (e.g.,

2026-02-15) suggests aggressive trading by large investors has decreased at current levels. They are likely observing the market's natural supply-demand balance or conducting a "Secondary Test" phase to confirm whether selling pressure has truly been exhausted.

Dimension Six: Support/Resistance Level Analysis and Trading Signals

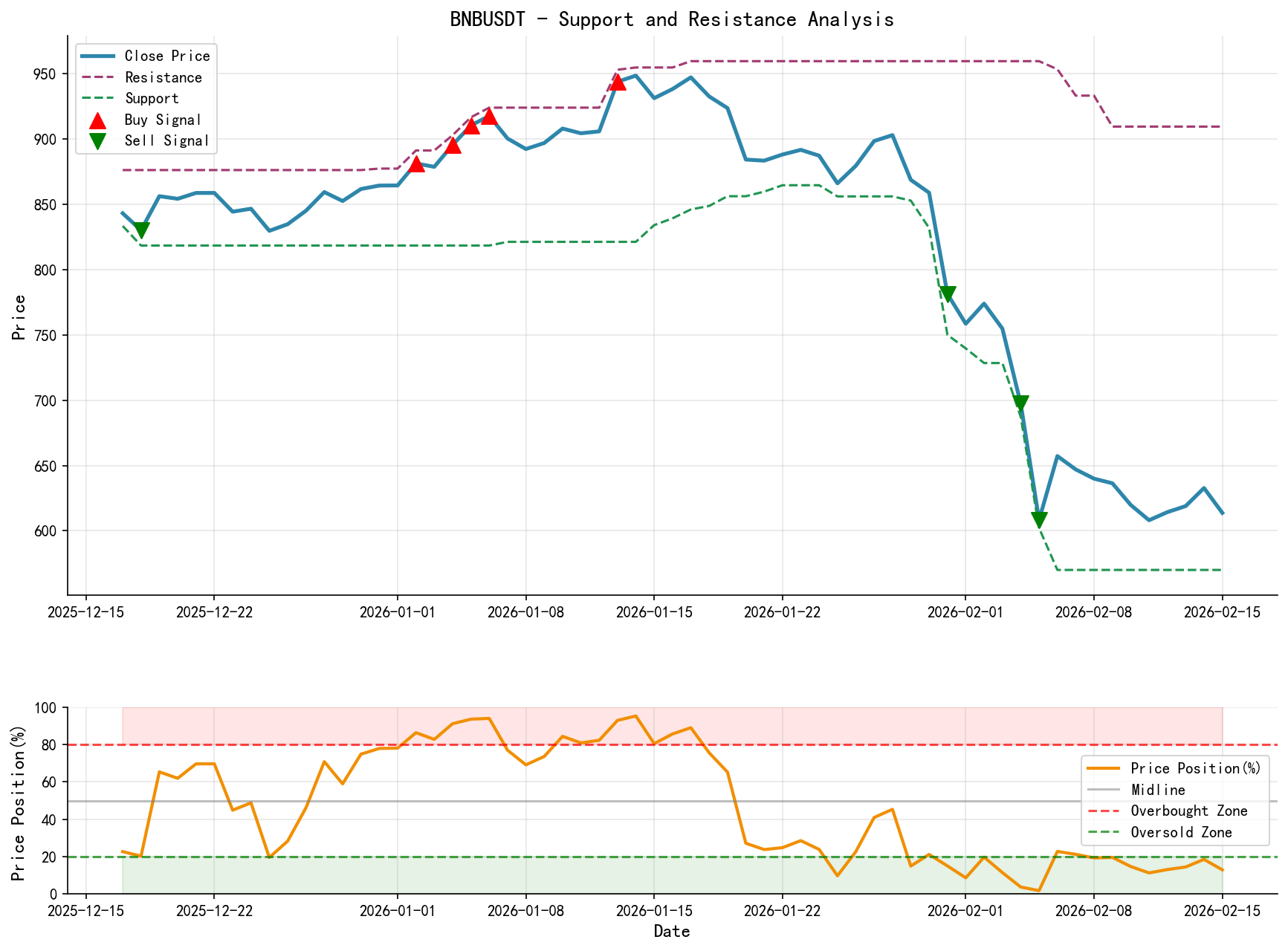

- 1. Key Levels:

- • Strong Resistance Zone (Supply Area): 780 - 830. This area was the consolidation platform before the late-January crash and the starting point of the panic selling. It is expected to have significant trapped supply; rallies to this zone will face strong selling pressure.

- • Minor Resistance: 680 - 720. The recent bounce high zone and a pause point during the decline.

- • Current Support/Demand Area: 570 - 610. The low of the long lower shadow formed on

2026-02-06(570.06) and recent consolidation lows form initial support. This is the low zone of the panic selling and must hold for any bottoming structure discussion. - • Lower Critical Support: 500 - 550. Should the 570-610 area fail, the market will seek longer-term support.

- 2. Integrated Wyckoff Events and Trading Signals:

- • Primary Event: The market has just experienced a clear "Selling Climax" (SC) event (around 2026-02-05). It is currently in the early stages of a potential "Automatic Rally" (AR) or "Secondary Test" (ST)."

- • Current Signal: Neutral/Stand Aside, preparing for potential bounce opportunities, but the primary trend remains down.

- • Preliminary Bullish Reversal Signals (Requiring Subsequent Confirmation): Price stabilizes above the 570-610 area, followed by a low-volume test that does not breach new lows, subsequently leading to an increase in volume on a rally breaking through the 680-720 resistance zone. This would be the first positive signal that demand is regaining control and a potential "accumulation" structure may be forming.

- • Bearish Continuation Signals: Price rallies to the 680-720 or 780-830 zones and exhibits clear signs of high-volume churning or decline (i.e., supply re-emerges), OR price directly breaks below the 570 key support on increasing volume.

- 3. Operational Suggestions and Risk Management:

- • Aggressive (Left-Side Traders): May consider a light test long position in the 600-620 area, with a strict stop-loss placed below 570. This trade aims to capture a technical bounce post-panic, targeting 680-720. Position size must be very light as the trend is not yet reversed.

- • Conservative (Right-Side Traders): Remain on the sidelines. Wait for the aforementioned "Preliminary Bullish Reversal Signals" to appear, particularly a high-volume breakout and hold above 720, before considering a long entry. Alternatively, wait for price to rally to key resistance (720 or 780) and show evidence of supply to initiate a short trade following the trend.

- • Critical Future Validation Points:

- 1. Validate Demand: Can price form a Higher Low (HL) above the 570-610 area?

- 2. Validate Supply Exhaustion: On any retest near 600, does volume continue to contract?

- 3. Validate Demand Entry: Does an upward breakout occur with significantly expanded volume (e.g., VOLUME_AVG_7D_RATIO > 1.5)?

- 4. Invalidation Signal: If price breaks below 570 on increasing volume, it means the post-panic support is invalid, the downtrend will likely resume, and all bullish hypotheses should be immediately abandoned.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding the accuracy or completeness of the content. Markets involve risks, and investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff volume-price market analysis is published daily before the 8:00 AM market open. Comments and shares are appreciated; your recognition is crucial. Let's work together to decipher market signals.

Member discussion: